Australian property prices: Which way are they going? And why it matters to your business

There has been much talk about the Australian economy and how it is tracking. We’ve written extensively about the economy in previous briefings (See: Outlook for 4 Key Sectors of the Australian Economy, 3 Long-term Risks Australian Businesses Should Be Thinking about Now, Outlook for Australian business (May 2022) ).

In this briefing, I want to focus on Australian house prices specifically because there is a lot of noise in the media about how much house prices have dropped and how much further they have to fall.

As you know, at Tenfold Business Coaching we like to go to the heart of issue and understand the data, and for that reason in this briefing I want to look beyond the headlines to the drivers of house prices.

In this briefing I explain:

1. What makes property prices go up

2. What drives demand for property

3. Impact of interest rate rises

4. What are the main players – Mirvac, Stockland – are predicting and planning

5. What this means for your business

Let’s dive in.

1. What makes Australian property prices go up

Ultimately the price of existing houses is based upon their replacement cost. For an existing house this would be the cost of purchasing a vacant block of land and the cost of getting a builder to build something comparable on that site. It sounds obvious. However, if more people are looking to buy land in new estate areas of a city, this drives up the cost of housing of all the other established suburbs in that city. Still, sounds obvious. As building costs go up (the cost of tradesperson labour and the cost of building materials), this adds to the replacement cost of a property. Again, pretty obvious.

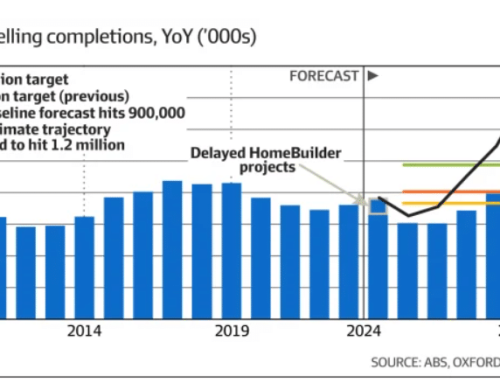

So, house prices everywhere are driven up by higher demand for blocks of land in new estates and higher demand for construction services.

2. What drives demand for property in Australia

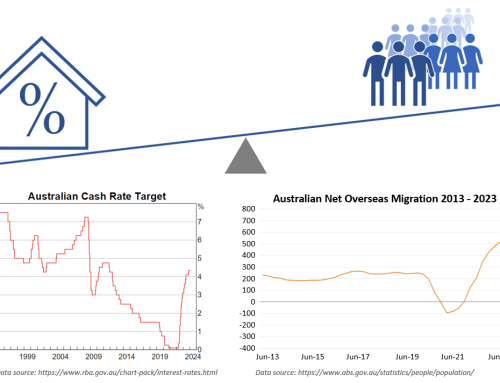

Many things drive demand, but two factors are prevalent: Immigration and the unemployment rate.

As we showed in previous briefings, Australia’s net migration (the overall number of people settling in the country) dropped below zero during COVID. This has now well and truly bounced back from historical levels of around 160,000 to 180,000 people. Current conservative government predictions are that it will be around 235,000 for several years, but independent estimates are that it will hit 300,000 people (an almost 200% increase!). That’s a lot more people looking to buy houses. Net migration at these levels will drive demand for new houses.

The unemployment rate is the second major contributor to demand for housing. As we’ve previously shown, Australia’s unemployment rate is at historically low levels. There are a lot more people in jobs with the money to spend on purchasing a house. When unemployment is low, whether they are in a single- or double-income family, people feel more confident in their ability to hold a job or get another better paid job.

This often translates into a desire to own a new house.

Also think about the adult children who didn’t move out of home during COVID (you might have a few in your house!). Many of these people are now settled into stable jobs and looking to move out of home. This means another household is being formed and another house is required.

3. What about higher interest rates? The impact of interest rate rises

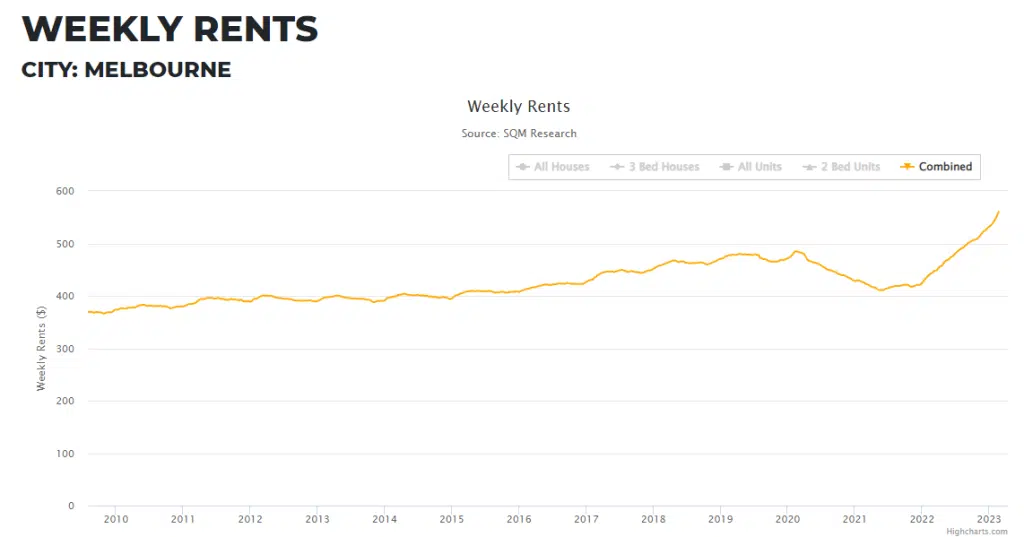

I’ve written before about how interest rates are reverting to their longer-term averages (See my briefing: Insights for business owners on interest rates, inflation and property prices). As interest rates started rising from May 2022, many would-be property investors stepped back from investing in property. Now that we’re seeing smaller interest rate rises and rents have gone up considerably, many investors are starting to feel more comfortable investing in residential property again.

It’s the combined demand for new housing by both owner occupiers and investors that pushes up the price of land and construction services.

4. What are the main players in the Australian home building sector experiencing on the ground?

Two of Australia’s largest publicly listed home builders, Mirvac and Stockland, recently made statements on what they’re experiencing in their businesses.

Mirvac

Mirvac are expecting to complete 2,500 residential builds this year. Their CEO made the following statements:

“While the RBA is likely to be done raising rates by the middle of the year, and with unemployment close to 50-year lows, Mirvac expects sentiment from prospective buyers to improve. The acceleration of population growth as immigration kicks back in over the course of 2023 should further help demand.”

“As soon as customers get visibility of the end of that [interest rates rising], then I think we will see those fundamentals come to the fore.”

Stockland

Stockland are expecting to complete 5,500 residential builds this year. Their CEO made similar comments:

“We’re going into this cycle with chronic housing undersupply – we’ve got rents rising because of it. Net overseas migration is going to exponentially increase compared to the last three years, and we’ve got high employment levels,”

“Sales in the December quarter [were] better than those in the September quarter and inquiries in January and February running 50 per cent higher than in December.”

What pressures in property prices mean for your business

The residential construction industry drives a large part of the Australian economy. Consider these specific attributes:

- It is very labour intensive (as opposed to the mining industry) so it supports many jobs.

- It is made up of many small businesses (as opposed to the multinationals that dominate the manufacturing industry).

- The industry is dispersed evenly across the country with builders, tradespeople and associated suppliers located in every city and town where people live.

- It ebbs and flows based on demand, unlike some other industries that aren’t impacted by cycles (for example, the demands on the healthcare industry are pretty consistent).

Add to this the wealth effect homeowners feel when house prices are going up. When this happens, homeowners are much more likely to feel comfortable spending more on all of the other goods and services we offer.

The trajectory for property prices is REALLY important in forecasting the likely demand in many of your businesses.

If you would like to know more about this topic and some of the research we’ve been doing, contact us and I’ll share the links with you.

Please note, this is NOT investment advice. My point is NOT to advise you to go out and purchase a property off the back of these observations. As a business coach, my purpose is to provide information and help you assess your options.