Long term risks Australian businesses should be thinking about now

In my last briefing I noted that there was a lot of media hype catastrophising high interest rates, property market crashes and recessions. (You can revisit the briefing from 9th August 2022 here: Insights into interest rates, inflation and property prices in Australia)

As humans we often respond to situations that are immediately in front of us and that is why I provided you with another (less alarmist) perspective on the media hype. However, as humans and business owners we sometimes miss those long term-changes and risks that have the potential to significantly shape the future of our businesses. Today I want to highlight several of these long-term changes that we as business owners need to watch and monitor.

In this briefing, I’ll provide insight and advice for Tenfold clients and business owners on:

1. Insolvency Risks

2. China Risks

3. Energy Costs

Our role as business coaches is to help you grow your business and profits, and also to ensure that we’re helping you grow a bulletproof business, one that can withstand any shocks and risks that may eventuate.

1. Insolvency Risks

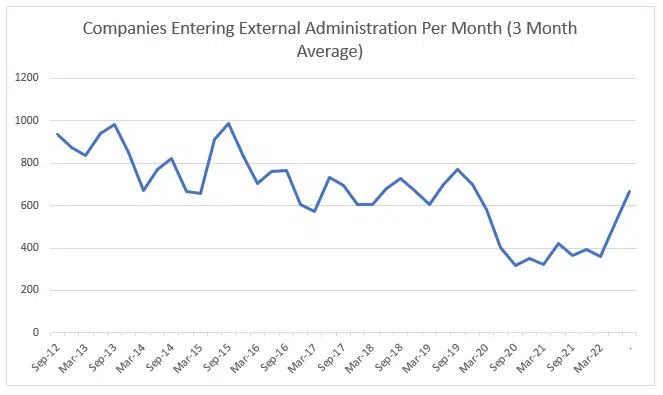

Many of you will remember that during the onset of COVID lockdowns, the federal government announced a pause on business insolvency and temporarily changed bankruptcy laws. Essentially it meant that it was much harder for a business to be deemed insolvent and for a director to be held liable for their business debts than in normal trading times. The pause ended on 1st January 2021, and now that most of the COVID business support measures have run out, insolvencies are on the rise.

Source: https://asic.gov.au/regulatory-resources/find-a-document/statistics/insolvency-statistics/

I’ve included a long-range graph of insolvencies over the last 10 years. You can see the recent bubble and the uptick of insolvencies trending back up to pre-COVID levels.

This rise in business insolvency has impacted the construction industry first, contributed to by fixed price contracts. In recent weeks we’ve seen the developer Caydon Property Group go into liquidation, and those in that industry know of other smaller builders who have also folded their businesses this year. As the impact of this flows into suppliers of these builders, be careful of any impact this wave of insolvency may have on your business. Another sector that is likely to follow with a significant uptick in insolvency is the manufacturing sector. Many are able to pass on the rises they’ve experienced in materials costs, but others will be struggling.

Advice for business owners: During this time, be more circumspect of who you provide credit to. A business won’t go into administration or be liquidated without there usually being warning signs. Watch carefully and complete your proper credit checks during this period.

Advice for business owners: Consider using the Personal Property Securities Register (PPSR) to register your interest over goods and services prior to payment. This can protect your ownership and give you the right to recover your goods if your client can’t pay.

You may be surprised by what you can actually register – for more information on PPSR, see: https://www.ppsr.gov.au/registering/you-create-registration/collateral-type-and-class

2. China Risks

China as a nation has grown off the back of supplying cheap goods to western countries for many decades. Western countries tolerated China not playing by the norms and standards (for example, stealing intellectual property from western companies) because it suited us to buy cheap products that improved our lives and standards of living. Now China wants to be a world power and play by their own rules, while western countries don’t want to give up or share that power.

United States military and intelligence organisations have significantly upgraded their assessment of the probability that China may take Taiwan by force in the next 7 years. Based upon current messaging from the US and Australia, it seems likely that both our countries would be drawn into such a conflict. It has been reported that the CIA estimate the chance of a conflict between the US and China in this decade at a probability of 70%. If this were to occur, then what does that mean for all the supply chains that Australia has with China? Our experience with the Russia-Ukraine war is that western countries are quick to impose restrictions on the aggressor.

While power prices have risen in Australia, consider the 500% rise in German electricity prices in the last 12 months. German manufacturers are finding that their normally profitable operations are no longer sustainable. Now consider if similar trade sanctions were imposed on China. What would happen if Australian businesses were no longer allowed to import Chinese goods? What would happen if Australian miners were no longer allowed to export minerals to China? It is a scary proposition to think about, but none-the-less, something to be aware of as we plan your business strategies and steer them forward.

Let me give you a perspective on what one forward looking business has been doing: Apple have been shifting some of their production volumes away from China to India since 2017, with estimates that Indian production volumes grew by 200% in just the last year. Apple identified that India poses less of a political risk to them than China and so if US-China tensions continue to increase, Apple aren’t as exposed to trade sanctions.

Advice for business owners: This is not a note to do anything now, it’s more of a reminder of this slow change in the world order and the need to stay across what is happening and begin to factor these developments into your business thinking. Whether you import directly from China, rely on Chinese goods and materials through your wholesaler or simply buy office equipment that is made in China, remain aware of the political and military tensions.

If you’d like to learn more about the slow-moving geopolitical changes, then this is a good source: https://www.youtube.com/watch?v=xguam0TKMw8

3. Energy Costs

We all experienced the huge rise in petrol prices earlier in the year when Russia invaded Ukraine. While prices have now moderated, this hides a longer-term trend in energy prices. Whether it is fuel, electricity or gas, expect energy prices to rise and stay higher over the coming years and beyond.

The reason for this is that over the last couple of years there has been a significant under-investment in new fossil fuel exploration. Take gas for example; this includes investment such as the costs associated with exploration to find new gas reserves, construction of the infrastructure to extract the gas and then pipe it to the cities. At the same time there has been significant new investment to grow renewable capacity. However, the investment in renewables is far less than it needs to be to keep up with the decline in fossil fuel infrastructure.

Here are some important statistics to understand what this means:

- It is estimated it will take between $120 – $150 trillion to fully complete the energy transition the world needs to make to achieve net zero emissions.

- Germany, a leader in the transition to renewables, has taken 20 years to move from 84% to 77% of their economy operating on fossil fuels. At their current rate it will take another 250 years to complete their transition

- Australia is further behind the transition to renewables, with 87% of the economy running on fossil fuels.

- Currently, renewables are 4 to 5 times more capital intensive than fossil fuel generation. Hopefully this will reduce as technology progresses.

As you can see, the path to transitioning from carbon intensive energy to renewable energy will take lots of investment and a significant amount time. In the meantime, we’ll be reliant on fossil fuels for energy and these have been under-invested in in recent years.

Advice for business owners: Expect energy and fuel prices to go higher and stay higher longer. Look at ways over the medium term to reduce your fuel and energy usage and consider any investment you’ll make in renewable power in light of the increased energy prices.

If you’d like to learn more about the energy transition journey, listen to: https://www.livewiremarkets.com/wires/why-the-stock-market-s-bubble-hasn-t-really-burst-yet , from the 25:50 min mark to the 32:35 min mark.

Hopefully this has given you some food for thought. Often success in business is as much about navigating the pitfalls as it is about counting the successes. Be aware of the long-term pitfalls and work with your Tenfold coach in Melbourne, Brisbane or Sydney to navigate them successfully.

Ash