Economic Insights for Australian Small Business Owners: 2 Indicators to Watch in the Next 3-5 years

Not everyone loves reading about geopolitical pressures or government spending. As business coaches, we take on the responsibility for monitoring economic trends and reading widely so we can bring you the highlights and the points you need to know.

In this briefing:

Economic update: what we’re seeing ahead

Getting ahead of the pack

Two indicators to watch in the next 3-5 years:

- Australian government spending

- China outlook

Many business commentators only look ahead 1 to 3 months out to advise you on how to position your business. As you know, we think this is pointless because most of your important business changes will take longer than 3 months to implement. If you do try to make strategic decisions on a short range view, then you’ll likely have to change again in the next 3 months and then the one after that.

But there is a lot you can do over three years, so at Tenfold we look at the medium- and long-term and help you understand the trends and forecasts so you can consider these in your business.

Economic Update: what we’re seeing ahead

As many of you know we’ve been positive about the economy since early 2020, whether it was the announcement of JobKeeper and the reduction in interest rates. During the back half of COVID and the reopening, it was the boom in demand for employees as COVID restrictions reduced and the resulting in unemployment dropped to 50-year lows. We’ve seen the types of conditions that assist business growth and most of you have been the beneficiary of these conditions.

We’re slightly less positive now.

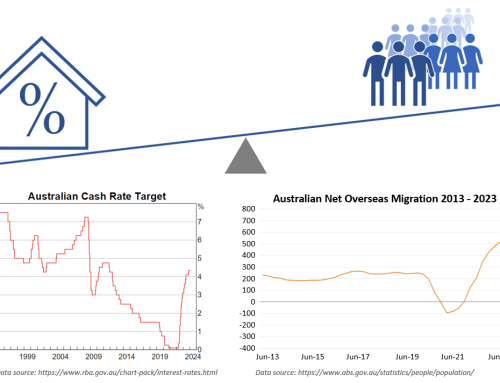

This is not a cause for concern, but a reminder that these ‘buoyant times’ might be coming to an end. The interest rate rises that started in mid-2022 have started to impact a critical mass of the population. The cost increases in fuel, electricity and gas are also starting to have an impact. Households in particular are feeling the pressure and we’re seeing changes in spending, saving and investing.

What this means for Tenfold clients: you need to be very aware of your forward indicators, things like website traffic, enquiry levels and the time it takes for quotes to convert to orders/contracts. We believe that now is the time to start increasing your marketing activities so that you’re ahead of the curve for when we begin to see a pullback in overall economic activity.

Getting ahead of the pack

The last two years have been about attracting labour – I started talking about this in our briefings from May 2021 onwards (See our client briefing from May 2021: Forecasting recruitment challenges in 2021-2022).

As coaches we’ve been driving you to expand your recruitment activities to maintain and grow your team to keep up with the demand in work. In today’s briefing I’m suggesting you should start to shift your focus to marketing and sales activities aimed at maintaining and growing revenue.

Let me be clear; I’m not suggesting any radical change. Instead, it’s about simply upping your marketing and sales activities to the levels you were running at pre-COVID. By investing more time and effort now versus your competitors, you’ll be ahead of them as this plays out.

Two indicators to watch in the next 3-5 years

Now let me explain two long-term drivers to be aware of and to watch in the next 3 to 5 years. The first one is Australian government spending. This will have a positive effect on Australia for the next 3 to 5 years. The second one is the China outlook. This could cause significant economic issues for Australia over the same time.

Indicator #1: Australian Government Spending

Recessions happen when businesses, governments, and individuals pull back on their spending.

Well, the Australian federal and state governments are doing their bit to support the economy, because they are still spending BIG. While we’ve seen some pull back on major projects in Victoria and NSW, the federal government announced in June a $2B social housing fund and a couple of weeks ago announced a whopping $10B investment for another housing fund. This is on top of the huge infrastructure spending that we’ve previously reported on (see our client briefing from Nov 2021: 3 Graphs Explain Why Recruitment and Retention are Important For the Next 3 Years)

As we pointed out in our briefing (see my business coach insights from Dec 2022: Australian Economy: Outlook For 4 Key Sectors In 2023), not all businesses will directly benefit, but over time most will benefit indirectly as construction related workers spend their money on other products and services.

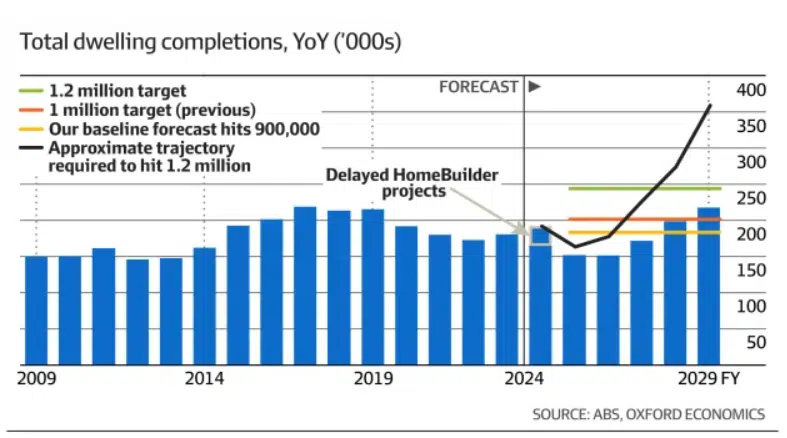

The scale of the federal government’s investment is so big that it’s unlikely they’ll actually be able to spend it over the timeframe they’ve promised. To give you some context, they’re aiming to build 1,200,000 new homes over five years. This target is excessively optimistic; a major developer in Perth explained that we’d be lucky to build half of the promised homes because there just aren’t enough tradespeople in Australia to complete the building works.

Below is a graph showing what a likely ramp up in construction activity would need to look like. This shows nearly double the number of homes being built in five years versus now. Based on an average apprenticeship taking 4 years, Australia would have to employ an additional 1,000,000 apprentices this year to even be close to having the labour to do this work.

Source: https://www.afr.com/property/residential/finally-the-focus-is-on-housing-supply-20230913-p5e4bt

What this does tell us is that the construction sector (which represents 9% of the Australian economy) will continue to support the broader economy over the next 5 years through this government spending.

What this means for Tenfold clients and small business owners: Look to the construction sector for flow on benefits as you work on plans for your business and your marketing.

Indicator #2: Outlook on China

These next graphs look at 2 key factors of the Chinese economy: population and property:

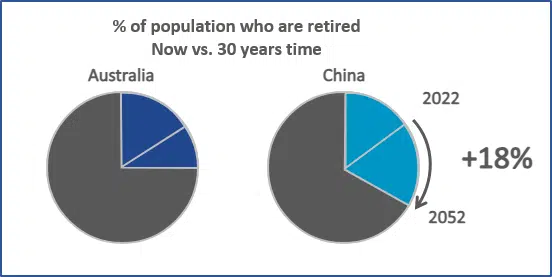

Graph 1: Aust vs China Retired Population 2022 – 2052

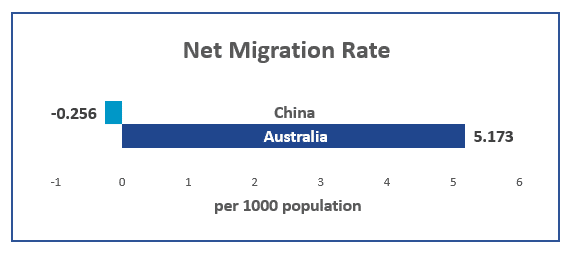

Graph 2: Aust vs China Net Migration Rate

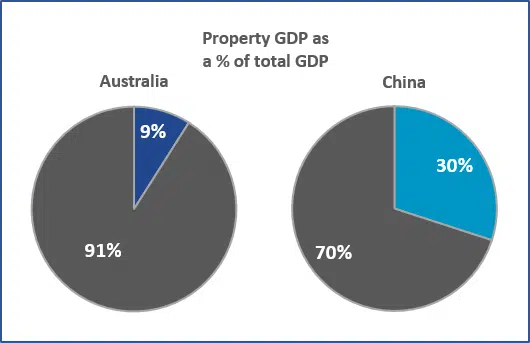

Graph 2: Aust vs China Property GDP

Let’s join the dots on what these statistics mean.

China faces a situation where their population is ageing, which means less working-age people to supply labour and fewer people to buy and consume the items the economy produces. The “one child policy” of China from 1979 through to 2016 means that there is a whole generation (who are currently aged 7 to 42 years old) that is significantly smaller in number than other generations.

Unlike many western countries, China doesn’t encourage immigration. This means they aren’t going to increase the number of working-age people and therefore they are likely to experience a significant decline in their population.

An ageing and declining population makes it hard for that country to grow and be prosperous. There are less working-aged people to employ and pay taxes and a lot of the economy goes to supporting the aged rather than other productive jobs. An ageing population also spends less and therefore China’s economy is going to be facing a situation where less people want to buy houses, or purchase goods and services. The Chinese economy, which has grown at such a fast rate over the last 30 years, will slow significantly and then probably decline.

This is not good news for China, but it is also bad news for Australia. 34% of our exports go to China and if they aren’t building as many houses, bridges and roads or buying as much baby formula, this is going to hurt our economy significantly.

Importantly the Chinese property sector is an major part of their economy and Australian exports are generally focused on the Chinese construction sector. Australia, through jobs and taxes on exports, has benefited from the 30-year growth in the Chinese economy. We need to be mindful that this might not continue.

These economic changes, along with the shifting geo-political view of China from being an economic trading partner to a potential military adversary, will alter the forecasts for Australia’s economic prosperity.

What this means for Tenfold clients and small business owners: There isn’t anything we can do in relation to China’s economic performance and Australia’s political relationships with them, but be aware how these factors will affect the overall economy. For businesses reliant on China for imports or reliant on the relevant mining industries, be aware of your exposure. We’ll keep you updated on what the large importers (i.e. Apple) and exporters (i.e. BHP) say and do regarding their China strategy.

Our team of business coaches and I will continue to monitor and discuss how these factors, and other indicators, impacting the economic landscape. We’re looking for risks and also advantages to keep you in front of the curve.

If you’d like to discuss any aspect, speak with your Tenfold business coach or drop me an email.

Ash

Ashley Thomson B.Eng. (Hons), Grad. Dip. Mgmt, MEI

Managing Director, Tenfold Business Coaching