Understanding recent insolvency events in Australia

It seems like the last couple of weeks have been full of headlines of builders going bust. First there was the residential builder, Porter Davis and their 1,700 customers and all of the trades that have lost money as a result of their insolvency. This was followed by the commercial building group Lloyd Group and then the other week it was Mahercorp (brands: Urbanedge and Eight Homes), another residential builder.

But it isn’t confined to the construction industry; the food delivery service Providoor went into liquidation last week as well. There are also many other stories of lesser-known companies succumbing.

While these insolvencies project an impression of doom and gloom, they are only a return to more normal levels of business failure after the COVID legislation that effectively prevented many businesses from being pursued for their debts and having to go into administration. To give you some context, I’ve updated the graph from my briefing on 26th September 2022. In it you will see that insolvency levels are not excessive and while they have jumped in the last 12 months, they have only bounced back to historical levels.

What happened to Porter Davis and Mahercorp?

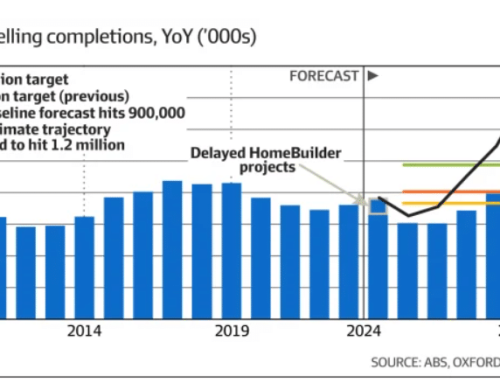

Let’s pull apart what has happened to some of these businesses to understand what is happening in the economy more broadly. Without knowing the specifics of the residential builders’ situations, it seems likely that both Porter Davis and Mahercorp benefited from the $25,000 federal government HomeBuilder grants in 2020 and 2021. While these grants ended in April 2021, the committed funds continued to flow up until September 2022. Many builders used the grant and adopted very competitive pricing to try and grow their market share. As an example, Porter Davis Homes grew their sales 17% over the 3 years to 2021/22.

When price rises hit the construction sector, those builders that had adopted competitive pricing found themselves in trouble. One way to trade out of their situation was to continue to sell hard, sign new building contracts and then use the building deposits to cash flow the completion of their existing projects. As a strategy, this can work except when the overall market turns down and there aren’t enough new sales to keep fresh deposits flowing. I’m not privy to the insights of these building companies’ liquidators, but I assume this could be the case with the builders who have recently entered liquidation.

In our role providing business coaching to businesses in Melbourne, Sydney and Brisbane, we foreshadowed an increase in insolvencies in our briefing in September 2022 and also outlined specific strategies for Tenfold clients to adopt to mitigate the risk (see my client briefing of 26 September 2022: Long Term Risks Australian Businesses Should Be Thinking About Now). In addition to what we wrote at the time, I will reiterate what we discussed at our recent business coaching boardroom briefing sessions:

- Focus in on a strong niche, don’t try and compete with everyone else in the marketplace

- Make sure you prioritise margins over market share

- Plan out your growth so you can do so in a consistent and measured way

Companies will continue to go into liquidation. Often the issues that lead to this have been allowed to remain in place for many years. While it is sad each time a business folds and impacts the owners, their employees and suppliers, the positive note is that it frees up the employees to seek out new roles at better-run companies. That’s you now and into the future.

Advice for Tenfold clients and business owners: Be alert but not alarmed by the recent spate of liquidations.

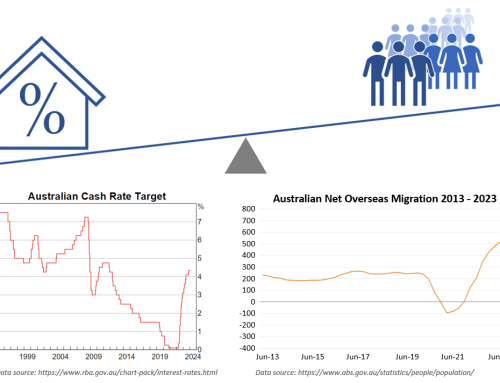

Other News: High immigration is positive

The federal Treasury released forecasts last week predicting overseas migration to reach 400,000 arrivals this financial year. See our previous briefing on the topic: Labour Market Insights – 3 graphs to show you why team recruitment and retention are so important for the next 3 years. The rate of 400,000 arrivals is roughly double what it was before COVID. Immigration levels like this will assist with more available workers and buffer Australia against an economic downturn.

Other News: House prices start to rise again

House prices in Melbourne, Sydney and Brisbane have now all increased for two months in a row. Even though the Reserve Bank raised interest rates again last week, these house price rises will settle consumer confidence and allow us business owners to operate in a more rational market.

Your Tenfold coach will be factoring these updates into your plans.

Ash

Ashley Thomson B.Eng. (Hons), Grad. Dip. Mgmt, MEI

Managing Director, Tenfold Business Coaching