Australian economy: outlook for 4 key sectors in 2023

Many Australian businesses we coach are planning important business decisions for 2023. Whether it is signing a new lease, agreeing to a large consignment of goods, purchasing a new factory, or upgrading your fleet of vehicles. These are all significant decisions that require a level of foresight into how the economy will perform. While we business coaches don’t have answers, we do trawl various industry and economic reports, assess the data and separate the fact from the hype. Today’s briefing lays out some of these facts for you.

There’s a lot of information about how the Australian economy is tracking, and the media is awash with reports of inflation, interest rate changes and recession predictions. Firstly, I think it is beneficial to separate the Australian economy from the US economy. Much of what we read is about the US economy and while that influences what we experience here in Australia, the two countries’ economies are very different, and so they act and react differently.

In recent briefings, I discussed interest rates, inflation and property prices (see my August briefing: Insights into interest rates, inflation and property prices in Australia, and then looked at key risks including insolvencies, China-US relations and energy prices (see my September briefing here: Long term risks Australian businesses should be thinking about now).

Today’s briefing is a summary of 4 sectors of the Australian economy to give you an unbiased view on what is going on. Whether or not you service these industries directly they are worth being aware of.

The 4 sectors discussed here are:

1. Construction

2. Mining

3. Manufacturing

4. Health

As a firm that provides business coaching services to small businesses in these sectors in Melbourne, Sydney and Brisbane, we closely monitor activity and lead indicators.

1. Construction sector outlook in 2023

Represents 7% of the Australian economy

Despite many of the predictions about property prices falling off a cliff, the construction sector remains relatively strong. Many builders were caught out when rising materials prices intersected with their fixed price contracts and this has seen some builders suffer in the last 12 months.

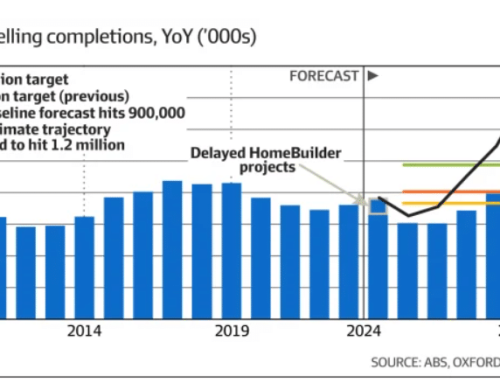

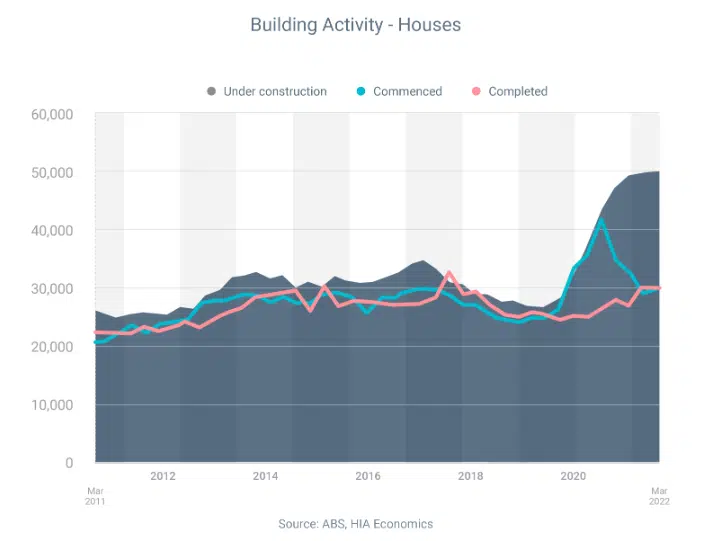

However, off the back of the HomeBuilder program (a grant that we’re never likely to see again in my lifetime) and the record level of government infrastructure projects (read our briefing on Infrastructure pipeline), there is plenty of work around for all of the construction sector.

As you can see from the graph below, the record number of new homes started due to the HomeBuilder scheme aren’t close to being completed due to commencement delays, weather disruptions and a lack of tradespeople to do the work. This means the construction sector will have a considerable overhang of work to complete well into 2023.

On the infrastructure side, a report by Infrastructure Partnerships Australia calculates that based upon the recent federal government social housing announcement and the various state government hospital announcements, the demand for workers to complete these projects will skyrocket:

- Social housing – projected 2.3 times increase in the workforce required to meet the schedules announced

- Hospitals – projected 3.5 times increase in the workforce required to meet the schedules announced

As you can see, the timeframes announced for these major projects are impossible to achieve because the labour doesn’t exist. This means the projects will be pushed out, meaning a very healthy pipeline of works leading out many, many years.

Tenfold Business Coaching perspective: The construction sector is strong, and even if new building contracts dry up and no new infrastructure projects are announced, the industry has plenty of work in the pipeline.

2. Mining sector outlook in 2023

Represents 15% of the Australian economy

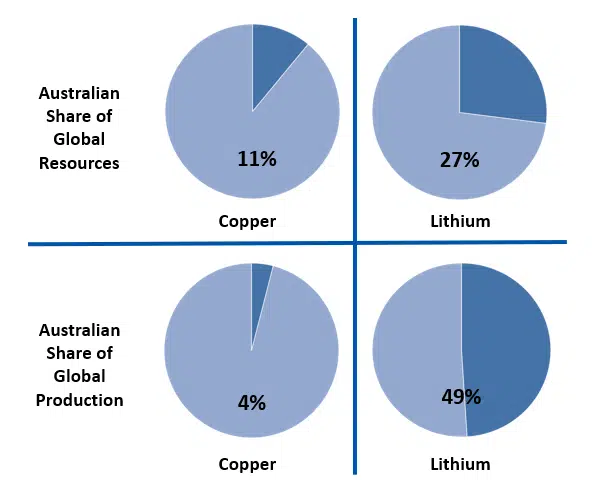

As I outlined in my September briefing, the changeover from fossil fuel to renewable energy will require a huge volume of mineral. The capital required to build wind farms and solar panels are 4 to 5 times more than the capital required to build coal power stations or gas fired power plants. That means more and higher priced minerals. Every electric vehicle produced requires 8 kilograms of lithium and 2.5 times more copper than an internal combustion engine.

Source: https://www.ga.gov.au/digital-publication/aimr2021/world-rankings

As the graph above shows, Australia is the biggest miner of lithium and one of the biggest miners of copper, the two minerals that will be in huge demand over many decades as the world transitions away from petrol and diesel engines to electric vehicles, and away from coal and gas power generation to renewables.

The world is starting to realise that we need a lot more of these minerals and so global reinvestment in existing mines is increasing along with exploration for new mines, much of which is happening in Australia.

Tenfold Business Coaching perspective: While many of our clients aren’t involved in the mining sector, those working in the mining industry whether in Queensland’s copper mines or BHP’s head office in Melbourne tend to have high wages and plenty of disposable income. They’ll be spending this on many of the discretionary products and services that some of you provide, from pools to gym memberships.

3. Manufacturing sector outlook in 2023

Represents 6% of the Australian economy

Manufacturers have had a hard time of it in the last couple of years. COVID led to reduced demand, then increased demand, then issues with supply of raw materials and then logistics cost increases. Going forward, manufacturing will be a bit of a mixed bag.

Export manufacturers have a strong tailwind that may persist for a while. As other countries such as the US increase their interest rates at a greater rate than Australia, the Australian dollar will decline compared to the US dollar. This means that export manufacturers earn a lot more for the goods they export than they normally would.

Manufacturers producing for the Australian market, while in many cases they have been able to charge higher prices for their goods in the last year, have also had to contend with high raw material prices, higher wages costs and higher interest rates on finance for machinery and factories. Those with unique products and in a strong niche will fare well; others will struggle.

Tenfold Business Coaching perspective: Some of you supply materials and services to the manufacturing sector. As we move into 2023 be mindful of these pressures and opportunities, and look for ways that you can be part of the solution in addressing their cost issues. Consider for innovative options to help them maintain control of their costs without overly impacting your profit margins.

4. Health sector outlook in 2023

Represents 13% of the Australian economy

Health has become the boom industry in recent years. There are so many drivers that are leading to a massive growth in health. These include:

- COVID-19 measures during 2020, 2021 and ongoing

- Announcement of new hospitals by various state governments

- General ageing of the population

- The aged care royal commission’s recommendation to increase funding to the sector

- The cost escalations seen in the National Disability Insurance Scheme (NDIS)

It is estimated that public health expenditure will grow by 5% this financial year, even off the back of the huge expenditure on COVID-19 in the last couple of years. It is likely to be the same or more in the following years.

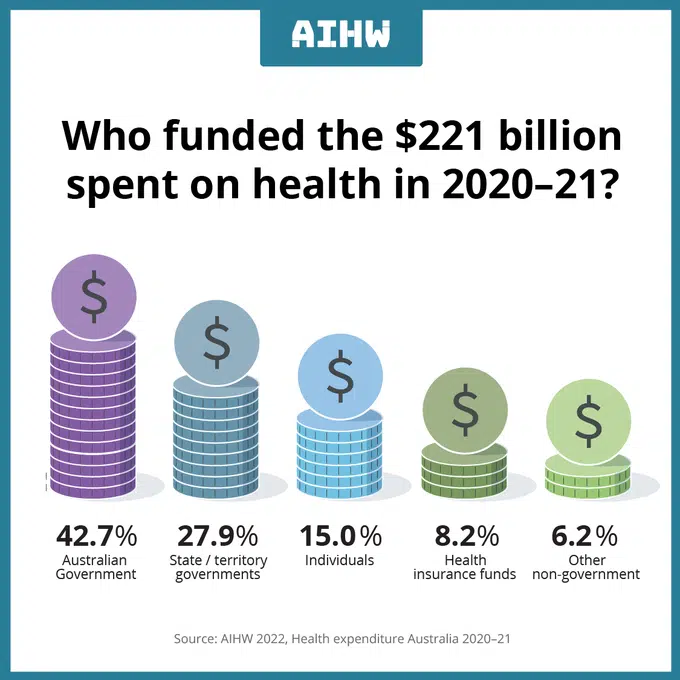

The important factor regarding the health industry is that the majority is paid for by the federal and state governments. This means that payments are assured and there is very little likelihood that they will change approach and suddenly reduce funding.

Tenfold Business Coaching perspective: Some of you are in several of the high growth areas of the health sector. Other clients we’ve been steering into certain niche markets where we can see good long-term opportunities.

In Summary

By all means pay attention to the short-term news cycle, but also take the time with your coach to assess the longer-term factors that drive the industry you’re in and the industry/s you service.

There is a lot of activity happening in many parts of the economy, so make sure that you’re positioned to take advantage of it. Keep discussing and working with your Tenfold business coach to ensure that you’re aligning with a strong niche market that will grow over time and draw your business along with it.

Our advice:

While all of the above sounds positive, an external shock such as the GFC or COVID-19 can disrupt these industry trends over the short and medium term. The best approach is to always keep a financial buffer of several months’ overheads in place and ready to draw upon if the need arises. For some businesses, a 2-month buffer might be sufficient, for others a 6-month buffer might be more appropriate.

Speak to your business coach and use the financial model of your business to run different “what if” scenarios and determine what might be a good peace-of-mind buffer to have on hand.