Insights into interest rates, inflation and property prices in Australia

As a business coach, I’m aware that there’s a lot of doom and gloom in the media from the rise in interest rates to high inflation and even talk of a recession.

And I know as a business owner this can play on your mind. The negative media can influence you into being more risk averse than you need to be or cause you to put off important business decisions.

In today’s briefing I want to apply a level of logic to many of the emotional attention-grabbing stories out there about the economy. My purpose as a mentor to small-medium business is to give you perspectives to update your plans and have confidence to implement them.

Topics in this briefing:

1. Interest Rates

2. Inflation

3. Likelihood of Recession

4. Labour Markets

5. Property Values

For each of these topics, I provide economic and market insights and then a perspective for Tenfold clients and owners of small-medium Australian businesses.

1. Interest Rate Perspective

Many of business owners have a home loan, an investment loan or a business loan and so you are impacted by any rise in interest rates. There is pessimism around households not being able to afford the rate rises we’ve seen in recent months, but what a lot of the commentary misses is that interest rates have been at the lowest we’ve ever seen.

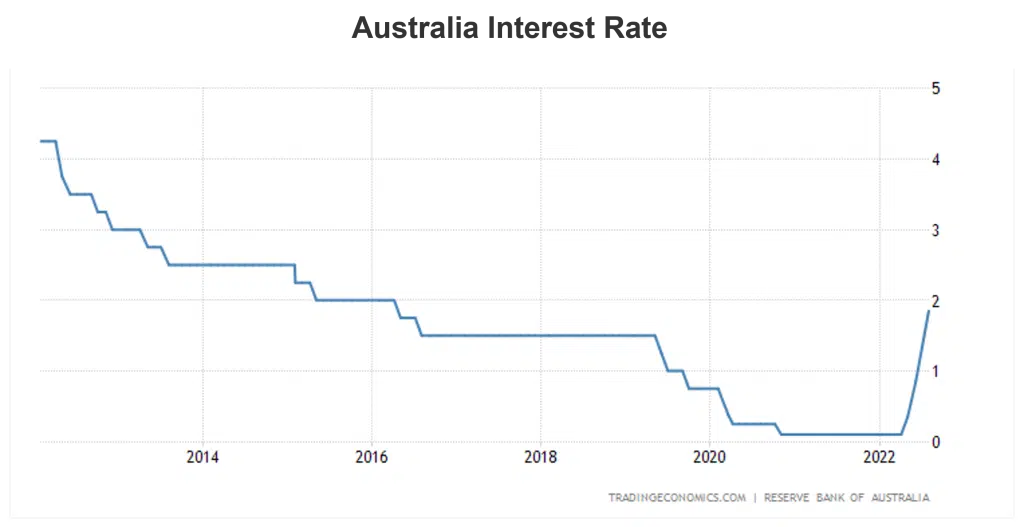

When the Reserve Bank of Australia (RBA) lowered the official cash rate to 0.1% (which meant the average home loan was about 2.5%), they explicitly said it was an emergency cash rate during the pandemic. To put things into perspective, here’s a graph of the official cash rate over the last 25 years. The RBA are suggesting they’ll raise the cash rate over time to 2.5% and the forecasters of financial markets are expecting it to hit 3.5%. However, both rates are still lower than the long-term average.

Perspective for business owners: Interest rates are rising, but off a very low base. Even if they rise as high as the most dire predictions, they’ll only be back to the same level we had in 2013.

2. Inflation Perspective

Another thing we’re hearing in the media is that inflation is out of control and is going to take massive interest rate rises to bring it back into control.

The Australian Trimmed Mean Inflation Rate (the most accurate indicator of inflation and the measure used by the Reserve Bank) rose to 4.9% in the year to June 2022. This is very high compared to historical levels and everywhere we see prices going up. I know from our experience at Tenfold, in the last week we’ve been notified that Telstra have put their mobile phone plan prices up and Yarra Valley Water have signalled that a price rise is coming.

However, many of the prices that caused this high rate of inflation have started to stabilise. If you’ve filled your vehicle up in the last two weeks, you’d know that the price of petrol has dropped significantly. Many of the other raw material prices have also fallen and once those lower prices flow through supply chains we’ll see prices stabilise, which will see inflation return to more normal levels.

The main reason the Reserve Bank is raising interest rates is to reduce inflation. For every 0.5% interest rate rise (like the one announced last week on 2nd August), this equates to an extra $2.1 billion that is spent by households and businesses on interest payments rather than goods and services. The interest rate rises we have been experiencing will have an impact over time, reducing inflation and therefore lessening the need for the Reserve Bank to continue raising interest rates.

Perspective for business owners: With the Reserve Bank aggressively raising rates, inflation is already showing signs of normalising.

3. Likelihood of a Recession Perspective

The United States has now entered a technical recession – the technical definition is two consecutive quarters of a country’s total economy (GDP) contracting rather than growing. While this might sound bad and remind us of the global financial crisis, so far the US recession is very mild.

Some are predicting that Australia may follow suit and go into recession. This will depend on how well the RBA balances the interest rate rises and inflation as explained above. The things to keep in mind as we contemplate what an Australian recession might look like are:

- Average household gearing has come down from a peak of 20.2% in 2018 and now stands at 16.4% (Note: Gearing is the amount of debt versus value. If a homeowner takes out a $800,000 loan against a property valued at $1,000,000, then their gearing is 80%.)

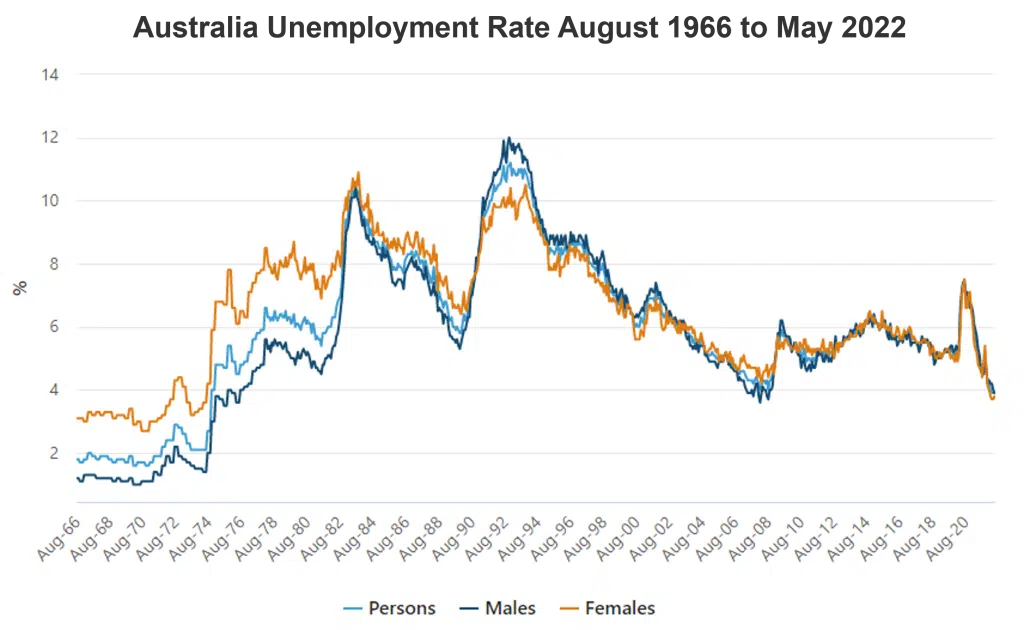

- The current unemployment rate is 3.5%, the lowest it has been in nearly 50 years

- As a result of all the COVID-19 stimulus measures, households and businesses have accumulated savings of around $350 billion.

Source: https://www.abs.gov.au/articles/historical-charts-august-1966-may-2022

These three factors of gearing, unemployment and savings should mean that a recession caused by rising interest rates should be mild and shouldn’t cause excessive economic pain to businesses. Recessions usually affect people on the margins. People who took out a large home loan in the last two years and put themselves under financial duress to do so might find themselves in trouble. Likewise marginal businesses that are running on very slim margins and with high debt loads may also experience trouble.

Perspective for business owners: If (and it’s a big if) a recession does occur in Australia, it will reset employment conditions and people’s expectations in preparation for the next period of growth.

4. Labour Market Perspective

The good news for us business owners is that raising rates to reduce inflation is likely to make recruitment easier. I’m a business coach, not a futurist, so I can’t promise this, but the whole purpose of raising rates is so that people buy less goods and services, therefore reducing demand for businesses’ good and services. This in turn forces some businesses to reduce staff hours or lay off workers thereby freeing up people for the stronger and more progressive businesses to employ.

We’re already seeing an increase in job applicants for some industries, with redundancies announced last week by Metricon in the building industry and Shopify in the software industry. These are two examples of businesses that grew too fast and assumed that the COVID-19 economic conditions would continue. At Tenfold business coaching we’re always preparing your businesses for a variety of economic outcomes, not just the best-case scenario.

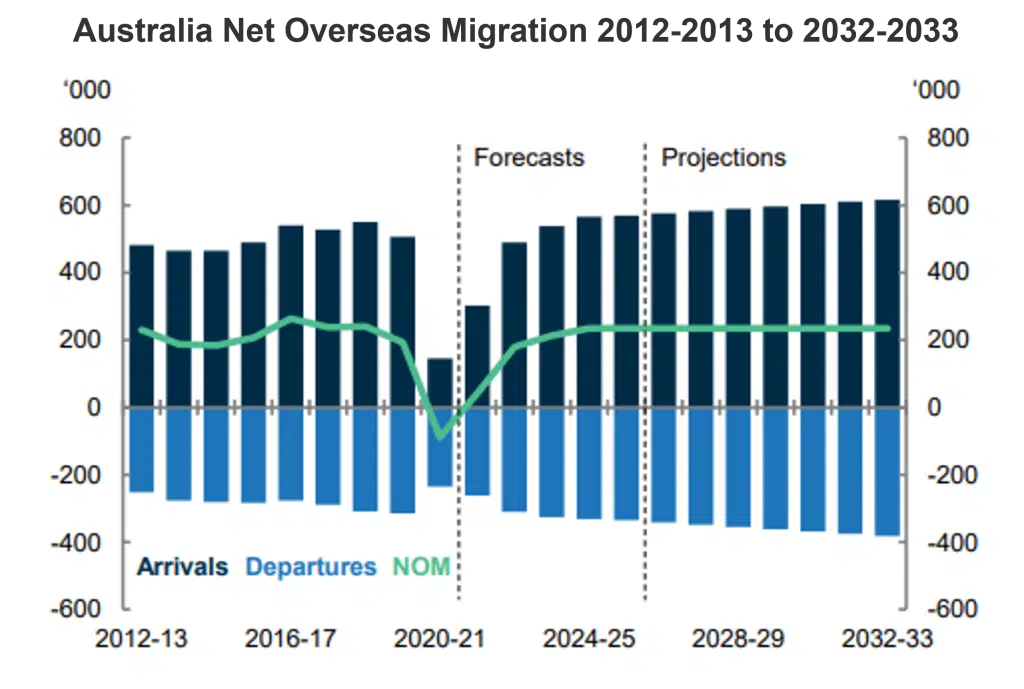

The freeing up of the current workforce will be supported by a forecast 180,000 net overseas immigrants arriving in Australia in 2022/23 and then growing to 213,000 in 2023/24 (see the green line in the graph below):

Source: https://population.gov.au/sites/population.gov.au/files/2022-04/2022-23_budget_overview.pdf

Perspective for business owners: The combination of rising interest rates and increased net overseas migration should see the labour supply and recruitment return to some kind of normality in 2023.

5. Property Values Perspective

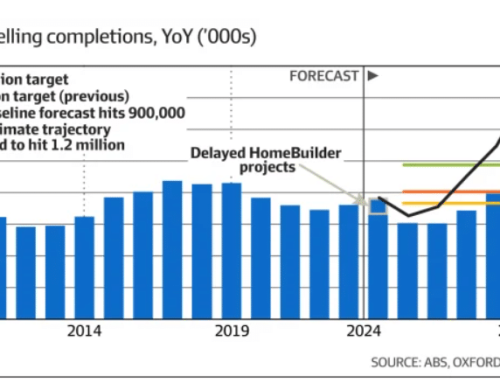

Another fear factor that is being played out in the media is the prospect of large declines in property values. Anyone who has had their home or business premises revalued recently will attest to the fact that they’ve seen a huge jump in the value of the property. As you’ll see from the graph below, we’ve had the biggest increase in residential property prices in many years. If we were to see a 20% decline in residential property prices in 2022, then we’d only be giving up the growth we gained in 2021.

With the large amount of accumulated savings (as highlighted above), many people sitting on significant equity in their existing real estate holdings and the ramp up of immigration, it shouldn’t take much for property prices to stabilise and then possibly grow again. Of course, each capital city market and the suburbs within them are different. Commercial, industrial, and retail property also have their own individual factors that influence their values.

Source: https://tradingeconomics.com/australia/housing-index

Perspective for business owners: Be alert to changing property values but try to keep a balanced view and don’t be overly influenced by media headlines of “edge cases” in marginal markets.

If you’d like to understand how to apply these insights to your business and your strategic plans, meet with a Tenfold business coach in Melbourne, Brisbane or Sydney. Contact us to arrange a call.