Victoria’s Inflation Outlook 2026: CPI, Cost-of-Living and the Flow-On Effects to Pricing and Demand

This article is the final chapter in Tenfold’s Victoria’s Economy 2026 series for owners in construction, trades and manufacturing. Throughout the series, we’ve explored labour pressures, credit conditions, business confidence, supply chains and infrastructure spending. This final instalment brings everything together by examining the economic force that shapes pricing, wages, demand and profitability more than any other: inflation.

Inflation affects every decision a business makes – from quoting and purchasing to hiring and investment. As a business coach working with Victorian tradies, builders and manufacturers, I see how inflation influences behaviour long before it shows up in the data. When inflation is high, owners hesitate to invest, clients delay decisions, and pricing becomes more complicated to manage. When inflation stabilises, confidence improves, demand becomes more predictable, and margins are easier to protect.

In 2026, Victoria’s inflation environment is shifting into a new phase – one that brings more stability, clearer expectations and better conditions for planning. This article explains what’s happening, what it means for cost‑of‑living pressures, and how it flows through to pricing and demand across construction and manufacturing.

Inflation Is Easing, Not Vanishing

Inflation in Victoria has eased significantly from its 2022-2023 peaks, but it hasn’t returned to the ultra‑low levels of the 2010s. Instead, it has settled into a more moderate range: high enough to keep pressure on wages and household budgets, but stable enough to support clearer business planning.

For SMEs, this environment is manageable. Material prices are more predictable, wage growth is steady rather than surging, and clients are adjusting to the new normal. The key message is reassuring: inflation is no longer the disruptive force it once was, and businesses with robust systems can navigate this environment with confidence.

Understanding CPI in 2026

Inflation has stabilised into a moderate, predictable range

After several years of volatility, CPI has settled into a more consistent pattern. Prices are still rising, but at a slower and more predictable pace. This stability supports better quoting, more accurate forecasting and clearer decision‑making for Victorian SMEs.

Goods inflation has eased as supply chains normalise

Many of the price spikes seen in materials, components and equipment have softened. With global supply chains stabilising and local manufacturing stepping up, goods inflation is no longer the primary driver of cost increases. This is particularly helpful for trades and manufacturers who rely heavily on imported inputs.

Services inflation remains sticky

Labour‑intensive services (from professional fees to subcontractor rates) continue to rise more quickly than goods. This reflects wage pressures, compliance requirements and the cost of delivering skilled work. For SMEs, this means labour remains the highest cost to manage.

Inflation expectations are more stable

When inflation expectations settle, clients become more comfortable committing to projects. This supports stronger demand in both construction and manufacturing, especially for commercial and industrial work.

Cost‑of‑Living Pressures: Still High, But More Predictable

Household budgets remain tight, but the pressure is no longer escalating

Victorian households are still managing higher mortgage repayments, elevated rents and increased everyday expenses. However, the pace of cost increases has slowed. This creates a more stable environment for consumer‑driven sectors, including renovation work and small‑scale construction projects.

Wage growth is steady rather than surging

Workers are still seeking wage increases to keep up with living costs, but the urgency has eased. This helps businesses plan staffing costs more accurately and reduces the risk of sudden wage shocks.

Energy costs remain a concern, but volatility has eased

Electricity and gas prices are still elevated, but they’re not rising at the same pace as in previous years. This stability helps manufacturers and trades with energy‑intensive operations plan more effectively.

Clients are adjusting to the new normal

Homeowners, developers and commercial clients have recalibrated their expectations. They understand that prices are higher than they were five years ago, and they’re more accepting of realistic quotes, provided the value is clear and communication is strong.

How Inflation Flows Through to Pricing in Construction

Material prices are stable enough to support confident quoting

Steel, timber, electrical components, plumbing fixtures and HVAC equipment have all reached a more predictable pricing range. This allows builders and trades to quote with greater certainty and reduces the risk of margin erosion on fixed‑price contracts.

Labour remains the primary cost pressure

Wages continue to rise gradually, driven by skill shortages and cost‑of‑living pressures. Businesses with strong supervision, clear scopes and efficient scheduling are managing these increases more effectively.

Clients are more accepting of price increases when communication is clear

Transparent quoting, detailed scopes and strong documentation help clients understand the value behind the price. Businesses that communicate well are maintaining healthy margins even in a competitive environment.

Variation management is more important than ever

With inflation still present, variations must be documented clearly and approved promptly. Businesses with strong systems are protecting margins and reducing disputes.

How Inflation Influences Demand in Manufacturing

Commercial and industrial demand remains steady

Manufacturers serving commercial construction, infrastructure, and industrial clients are experiencing consistent demand. Stable inflation supports predictable ordering patterns and reduces the risk of sudden cancellations.

Local sourcing continues to grow

With global pricing stabilising but still elevated, many Victorian businesses are choosing local suppliers for reliability and speed. This trend supports local manufacturing and creates opportunities for fabricators, machinists and component producers.

Maintenance and upgrade work remains strong

Businesses are investing in maintaining and improving existing equipment rather than committing to major capital purchases. This supports steady demand for machining, welding, fabrication and electrical upgrades.

Pricing stability supports better planning

Manufacturers can plan production schedules, purchasing and staffing more effectively when input costs are predictable. This stability supports stronger profitability.

Why Inflation Stability Supports Business Growth

Better forecasting and clearer decision‑making

When inflation is predictable, businesses can plan with confidence. This supports investment in equipment, hiring and capacity expansion.

More accurate pricing and stronger margins

Stable input costs allow businesses to price accurately and protect margins. This is particularly valuable for fixed‑price work.

Improved client confidence

Clients are more willing to commit to projects when they understand the pricing environment. This supports stronger demand across construction and manufacturing.

Reduced financial stress

With fewer surprises in material and labour costs, businesses can manage cash flow more effectively and reduce reliance on short‑term finance.

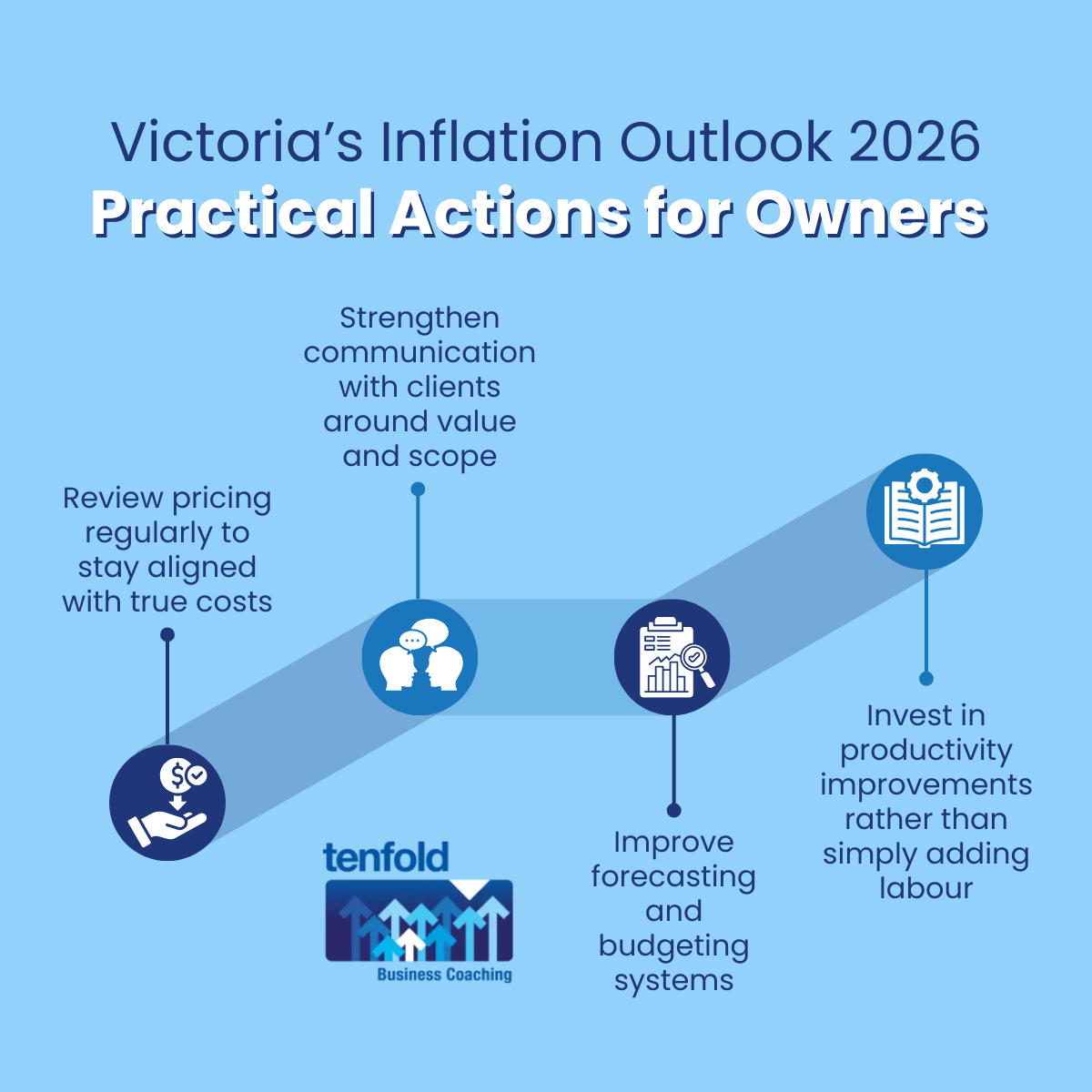

Practical Actions for Owners in 2026

Review pricing regularly to stay aligned with true costs

Even with stable inflation, costs continue to rise gradually. Regular pricing reviews ensure margins remain healthy and prevent under‑quoting.

Strengthen communication with clients around value and scope

Clear communication builds trust and reduces price sensitivity. Clients who understand the value behind the price are more likely to proceed with projects.

Improve forecasting and budgeting systems

Accurate forecasting helps businesses anticipate cost changes, manage cashflow and plan capacity. Strong systems support better decision‑making.

Invest in productivity improvements rather than simply adding labour

With labour costs rising steadily, productivity improvements deliver more substantial returns. This includes better supervision, clearer documentation and improved scheduling.

Tenfold Insights: What We’re Seeing Across Victoria

Across the businesses we coach, the strongest performers are those who treat inflation as a manageable factor rather than a threat. They review pricing regularly, communicate clearly with clients and invest in systems that support accurate forecasting. These businesses are maintaining strong margins and steady demand even in a higher‑cost environment.

We’re also seeing that businesses with strong internal systems are attracting better clients. In a cautious environment, clients gravitate toward operators who demonstrate professionalism, reliability and financial stability.

Inflation Is Manageable, and Strong Operators Are Well Positioned

Victoria’s inflation outlook for 2026 is stable, predictable and manageable. CPI has eased, cost‑of‑living pressures are no longer escalating, and pricing across key materials has stabilised. For construction and manufacturing businesses, this creates a foundation for confident planning, stronger margins, and more reliable demand.

As a business coach working with Victorian tradies, builders and manufacturers for over 20 years, I’ve seen how stability (even at higher price levels) supports growth. If you want support strengthening your pricing, forecasting and financial systems, learn more about how Tenfold’s business coaches work one‑on‑one with owners through our business coaching services.

Table of Contents

- Inflation Is Easing, Not Vanishing

- Understanding CPI in 2026

- Cost‑of‑Living Pressures: Still High, But More Predictable

- How Inflation Flows Through to Pricing in Construction

- How Inflation Influences Demand in Manufacturing

- Why Inflation Stability Supports Business Growth

- Practical Actions for Owners in 2026

- Tenfold Insights: What We’re Seeing Across Victoria

- Inflation Is Manageable, and Strong Operators Are Well Positioned