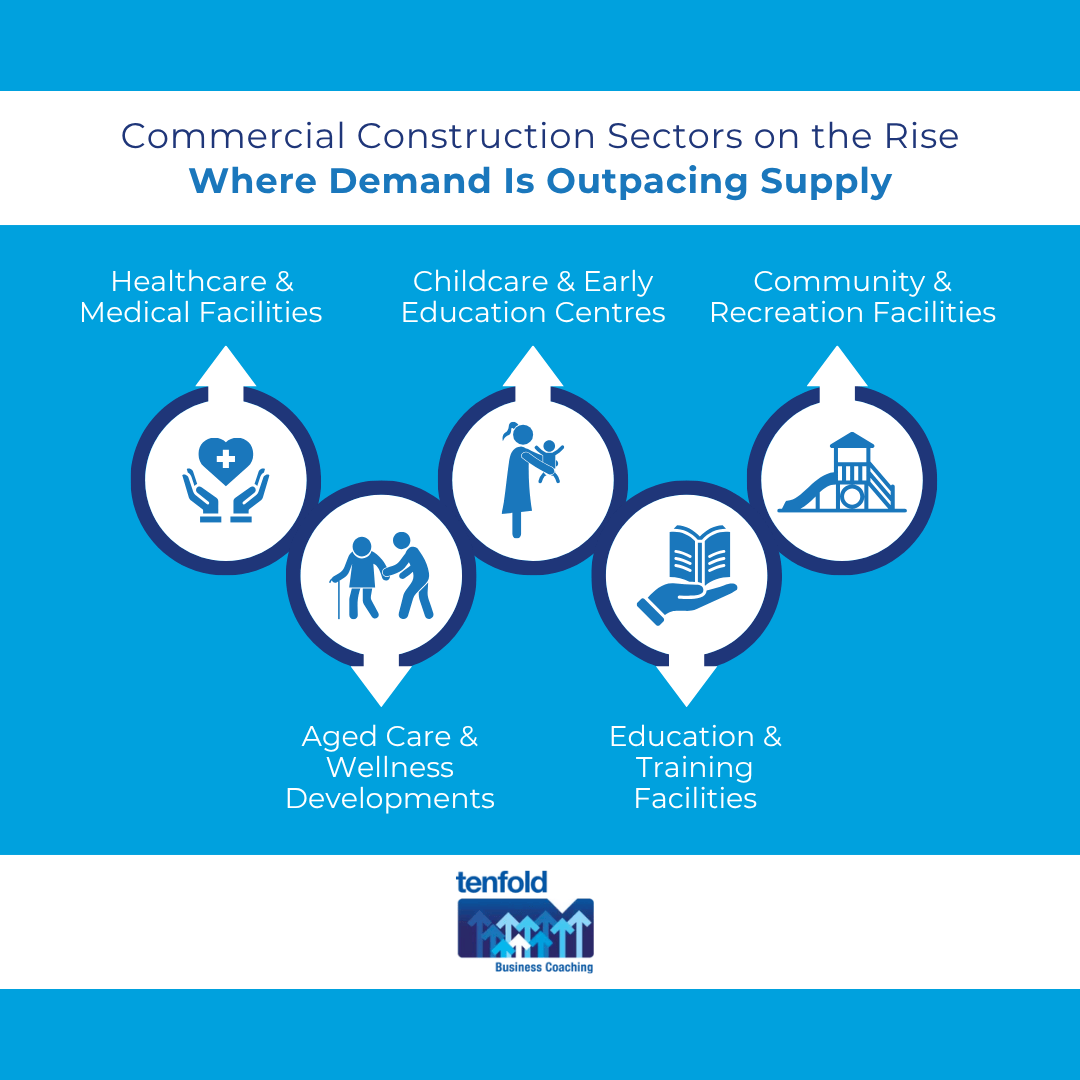

Commercial Construction Sectors on the Rise – Where Demand Is Outpacing Supply

In part one of this series, we explored why mid-size commercial construction is emerging as a new growth engine for experienced residential builders. With residential activity softening and non-residential approvals climbing, the market is clearly shifting. According to recent ABS data, non-residential building approvals have continued to rise in 2025, driven by demographic pressures, government investment, and the need for community infrastructure. Builders who are ready to diversify can find strong, sustainable opportunities in sectors that offer reliable pipelines and long-term demand. With the support of next level business coaching, they can navigate this transition with confidence and clarity.

Healthcare and Medical Facilities – A Business Coach’s View on Stability

Healthcare remains one of the most active and resilient sectors within the mid-size commercial construction industry in Australia. In recent years, there has been an upsurge in the development of satellite clinics, day hospitals, and allied health hubs, which are being constructed across both metropolitan and regional areas. This growth is driven by the need to cater to an increasingly ageing population as well as the decentralisation of health service delivery, aiming to improve access and convenience for local communities.

Government funding continues to flow into health infrastructure projects, especially targeting outer suburbs of major cities and regional centres where residents often experience limited access to comprehensive healthcare services.

The typical size of these projects generally ranges from about two million dollars up to fifteen million dollars. Such projects are particularly suitable for construction companies that possess strong project management skills, extensive experience in navigating compliance-heavy environments, and a proven track record of delivering quality work on time and within budget.

Additionally, business coaching services can play a crucial role in helping builders and contractors position themselves effectively for success in this competitive market. These services can assist in refining tender strategies, establishing productive relationships with health-focused developers and consultants, and aligning operational practices with the specific requirements of the healthcare sector, thereby enhancing their ability to secure and successfully deliver these vital infrastructure projects.

Childcare and Early Education Centres – Growth Corridors and Investment Appeal

Childcare remains a high-demand sector across Australia, particularly in rapidly developing growth corridors where an increasing number of young families are choosing to settle and establish their homes. Both federal and state governments continue to actively support early education through a variety of grants, subsidies, and planning incentives designed to encourage the development of quality childcare services. At the same time, institutional investors are increasingly recognising the stability and steady returns associated with childcare real estate, leading to greater financial backing for this sector.

Builders who have experience with residential workflows find themselves in a strong position to transition into the childcare facility space. To do so effectively, they often seek guidance from experienced business coaches who can assist them in navigating complex licensing requirements, meeting accessibility standards, and engaging effectively with various stakeholders, including local councils and community groups. Despite the ongoing rise in operational costs, the essential and ongoing need for childcare facilities ensures that this sector remains a viable and highly profitable opportunity for mid-sized operators looking to expand or enter the market.

Community and Recreation Facilities – Local Councils Driving Urban Renewal

Community infrastructure is experiencing a significant renaissance across many Australian cities and regional towns. Local councils are actively investing substantial funds into developing a wide variety of facilities, including modern sports pavilions, state-of-the-art aquatic centres, and multi-purpose community hubs that cater to the diverse needs of local populations. These projects are typically funded through a combination of local government budgets, which are sometimes supplemented by state government initiatives and federal grants, creating a reliable and consistent pipeline of tenders for builders who have a strong understanding of public sector procurement processes.

The post-COVID urban renewal efforts in Australia have further accelerated the demand for spaces that encourage health, social connection, and community resilience. Builders and construction firms that can demonstrate extensive experience with design and construct (D&C) contracts, as well as effective stakeholder consultation skills, are particularly well-positioned to secure work in this expanding sector. Additionally, engaging in business coaching can greatly support builders by helping them develop comprehensive capability statements and robust compliance frameworks that align with local council expectations and regulatory requirements.

Aged Care and Wellness Developments – Where Design Meets Demand

Australia’s ageing population is significantly increasing the demand for aged care services and wellness-focused living environments across the country. These types of developments are complex and multifaceted, typically combining various elements such as accommodation, healthcare, and lifestyle features into cohesive communities. They often embody high standards of design, prioritising accessibility and functionality to cater to the needs of elderly residents. Although these projects tend to require substantial capital investment, they offer builders and developers longer project pipelines and multiple repeat opportunities, especially for those who can consistently deliver high-quality outcomes.

Typical projects in this sector may include independent living units, specialised wellness centres, and integrated care facilities that provide comprehensive support. For builders aiming to enter this industry, it is crucial to be prepared for stringent compliance requirements and extensive stakeholder coordination, which are vital for the successful planning and execution of these developments.

As the population continues to age, the growth of such facilities is expected to accelerate, making this an increasingly vital segment of the Australian property and healthcare landscape. With next level business coaching, contractors can build the systems and partnerships needed to thrive in this complex but rewarding sector.

Education and Training Facilities – Investing in Skills Infrastructure

Government investment in education across Australia is significantly increasing the demand for mid-sized commercial projects, particularly within sectors such as TAFE, trade training centres, and STEM (Science, Technology, Engineering, and Mathematics) facilities. These educational facilities are either being upgraded to meet modern standards or constructed anew to ensure they adequately support Australia’s future workforce.

Builders who possess a thorough understanding of institutional workflows, along with the ability to manage complex technical specifications, are currently in high demand. Typical projects often include the development of specialised labs, practical workshops, and versatile multipurpose classrooms. Special emphasis is also placed on designing these facilities to be energy-efficient and accessible to all users, reflecting Australia’s commitment to sustainability and inclusivity. Additionally, business coaching services play a crucial role by helping builders identify new opportunities within this expanding market. These services assist in refining their tender bids and building strong, strategic relationships with education departments and private training providers across Australia, fostering a robust investment environment for contemporary educational infrastructure.

Sector-Specific Challenges and Rewards – What Business Coaching Can Help You Navigate

Each sector presents its own mix of compliance requirements, stakeholder expectations, and delivery models. Healthcare and aged care demand strict adherence to health regulations and accessibility standards. Childcare and education require familiarity with licensing and safety protocols. Community facilities often involve council tendering and public consultation. Builders must be prepared to manage complexity, coordinate with multiple stakeholders, and deliver to high standards. Business coaching can provide the strategic support needed to build internal systems, train teams, and develop the documentation required to compete effectively.

How Builders Can Identify Their Best Fit – A Next Level Business Coaching Approach

Choosing the right sector starts with understanding your team’s strengths, your existing client base, and your supplier network. Builders with strong residential experience may find childcare and community facilities a natural fit. Those with technical expertise might lean toward education or healthcare. Business coaches can help builders assess their capabilities, identify gaps, and develop a roadmap for entry. By aligning skills with sector needs, builders can reduce risk and maximise reward. Business coaching services also support builders in building strategic partnerships, refining their brand positioning, and scaling sustainably.

What’s Next – Breaking Into Commercial Work with Confidence

In part three of this series, we’ll explore how builders can successfully transition into mid-size commercial construction. We’ll cover strategies for tendering, compliance, and partnerships, and provide practical tools to help builders win work and deliver with confidence.

Whether you’re already exploring commercial opportunities or just starting to consider the shift, Tenfold Business Coaching can help you take the next step. Contact us today to learn how tailored business coaching can support your growth in this evolving market.

FAQs – Business Coaching Insights for Builders

Which commercial sectors have the most consistent project pipeline?

Healthcare, childcare, and education are consistently funded and offer stable demand across metro and regional areas.

Are government-funded projects better for new entrants?

Yes. They often come with clearer scopes, reliable funding, and structured tender processes that suit builders new to commercial work.

How much competition exists in childcare and medical construction?

These sectors are active but not saturated. Builders with strong compliance and stakeholder skills can carve out a niche.

What are the most common regulatory hurdles in these sectors?

Fire safety, accessibility, and energy efficiency standards are stricter than in residential builds and require careful planning.

Which sectors offer the best balance between risk and reward?

Childcare and education offer steady demand and manageable complexity, while aged care and healthcare offer higher margins with more compliance.