Victoria’s Business Confidence 2026: Investment Intentions and What They Signal for Demand in Construction and Manufacturing

This article is part of Tenfold’s Victoria’s Economy 2026 series for owners in construction, trades and manufacturing. In earlier instalments, we explored labour pressures, credit conditions, business risk and infrastructure spending. This article turns to a topic that ties all of those threads together: business confidence. Confidence shapes investment, hiring, purchasing and project decisions – and in 2026, it’s one of the clearest indicators of where demand is heading.

As a business coach working with Victorian trades, builders and manufacturers, I see firsthand how confidence influences behaviour long before the data shows it. When owners feel optimistic, they invest in equipment, expand teams and take on larger projects. When confidence dips, they delay decisions, reduce risk exposure and tighten cash flow. Understanding where confidence sits in 2026 helps you plan your own capacity, pricing and investment strategy with clarity.

Confidence Is Cautious, Not Collapsing

Business confidence in Victoria heading into 2026 is best described as “cautiously steady.” Owners are more optimistic than they were during the peak of interest rate uncertainty, but they’re not yet ready to accelerate aggressively. Investment intentions are rising slowly, particularly in equipment, technology and operational improvements. Hiring intentions remain modest but positive, especially in businesses with strong pipelines or recurring commercial work.

For construction and manufacturing, this environment signals stable (not booming) demand. Businesses with strong systems, clear scopes and reliable delivery are winning work consistently, while those relying on instinct or inconsistent processes are finding it harder to convert opportunities. The message is reassuring: demand is there, but it’s flowing toward operators who demonstrate capability, professionalism and financial stability.

What Business Confidence Really Measures

Confidence isn’t just a mood; it’s a leading indicator of economic behaviour. When confidence rises, businesses invest in equipment, expand capacity, hire staff and commit to larger projects. When confidence falls, they delay decisions, reduce spending and focus on short-term survival.

In 2026, confidence is being shaped by several factors: stabilising interest rates, clearer government infrastructure pipelines, easing supply chain pressures and a more predictable labour market. While none of these factors is perfect, together they create a more stable environment than the one businesses faced between 2021 and 2024.

For Victorian SMEs, this stability is valuable. It allows owners to plan with greater certainty, price with greater confidence, and invest with clearer expectations.

How Confidence Is Shaping Investment Intentions

Gradual increase in equipment and machinery investment

Many Victorian manufacturers and trade contractors delayed equipment upgrades amid volatility in interest rates. Now that rates have stabilised (even if they remain elevated), owners are beginning to revisit these decisions. The focus is on equipment that improves productivity, reduces labour dependency or expands capacity in high‑margin areas. This gradual increase in investment signals steady demand for fabrication, installation and commissioning work.

Growing interest in technology and automation

Businesses are increasingly investing in software, automation and digital tools to improve efficiency. This includes job management systems, estimating software, CNC machinery, robotics and workflow automation. These investments are driven by a desire to reduce rework, improve scheduling and strengthen profitability. For trades and manufacturers, this signals demand for installation, integration and ongoing maintenance services.

Selective expansion of facilities and capacity

Some businesses, particularly those with strong commercial or government pipelines, are exploring expansions to factories, workshops or storage facilities. These decisions are being made cautiously, with owners prioritising staged expansions rather than large, upfront commitments. This creates opportunities for builders, civil contractors, electricians, plumbers and fabricators involved in commercial fit-outs and industrial upgrades.

Renewed focus on maintenance and asset upgrades

Even businesses that aren’t ready to expand are investing in maintaining and upgrading existing assets. This includes electrical upgrades, HVAC improvements, safety compliance work, machinery servicing and building maintenance. For contractors, this signals a steady flow of smaller, reliable jobs that support cash flow and recurring revenue.

What Confidence Means for Hiring Intentions

Hiring intentions in 2026 are positive but measured. Businesses want to grow, but they’re cautious about adding fixed labour costs in a tight wage environment. Instead, they’re focusing on strategic hires: supervisors, experienced tradespeople, estimators and production specialists who can improve productivity and reduce rework.

Apprenticeship hiring remains steady, with many businesses recognising the long-term value of developing talent internally. However, owners are more selective, prioritising candidates who demonstrate reliability, communication skills, and a willingness to learn.

For trades and manufacturers, this means competition for skilled labour remains strong, but businesses with strong cultures, clear systems and reliable pipelines are attracting better candidates.

How Confidence Influences Demand in Construction

Commercial and industrial demand remains stable

Commercial clients are cautiously optimistic. They’re investing in maintenance, upgrades and compliance work, but they’re more selective about large capital projects. This creates steady demand for electrical, HVAC, plumbing, fabrication and general building services. Businesses that can demonstrate reliability, documentation and safety performance are winning more of this work.

Residential construction remains subdued but predictable

High interest rates and tighter credit continue to suppress new home starts. However, renovation and extension work remains resilient, driven by homeowners choosing to improve rather than move. This creates opportunities for builders, carpenters, electricians, plumbers and specialist trades. The demand is not explosive, but it is consistent – especially for operators with strong reputations and clear communication.

Civil and infrastructure demand is supported by government spending

Victoria’s shift toward maintenance and mid‑scale infrastructure projects creates a stable pipeline for civil contractors, commercial trades and manufacturers supplying government work. Confidence in this sector is higher than in residential construction because funding is clearer and demand is more predictable.

How Confidence Influences Demand in Manufacturing

Steady demand from commercial and industrial clients

Manufacturers supplying commercial construction, infrastructure and industrial clients are seeing stable demand. Clients are placing more consistent orders, though often in smaller batches. This reflects cautious optimism: businesses want to maintain operations but avoid overcommitting.

Increased interest in local manufacturing

Supply chain disruptions over the past few years have encouraged many Victorian businesses to source locally. This trend continues in 2026, particularly for specialised fabrication, custom components and short‑run production. Manufacturers with strong quality control and reliable lead times are benefiting from this shift.

Opportunities in maintenance, repair and overhaul (MRO)

As businesses delay major capital purchases, they’re investing more in maintaining and upgrading existing machinery. This creates demand for machining, welding, fabrication, electrical upgrades and component replacement. For manufacturers, MRO work provides steady, recurring revenue.

Why Confidence Matters for Pricing and Margins

Confidence influences how clients respond to pricing. When confidence is low, clients become more price‑sensitive and delay decisions. When confidence stabilises, they focus more on value, reliability and capability.

In 2026, clients remain cautious but are more willing to accept realistic pricing, especially when contractors provide clear scopes, transparent communication, and strong documentation. Businesses with disciplined pricing models and consistent delivery are maintaining healthy margins, even in a competitive environment.

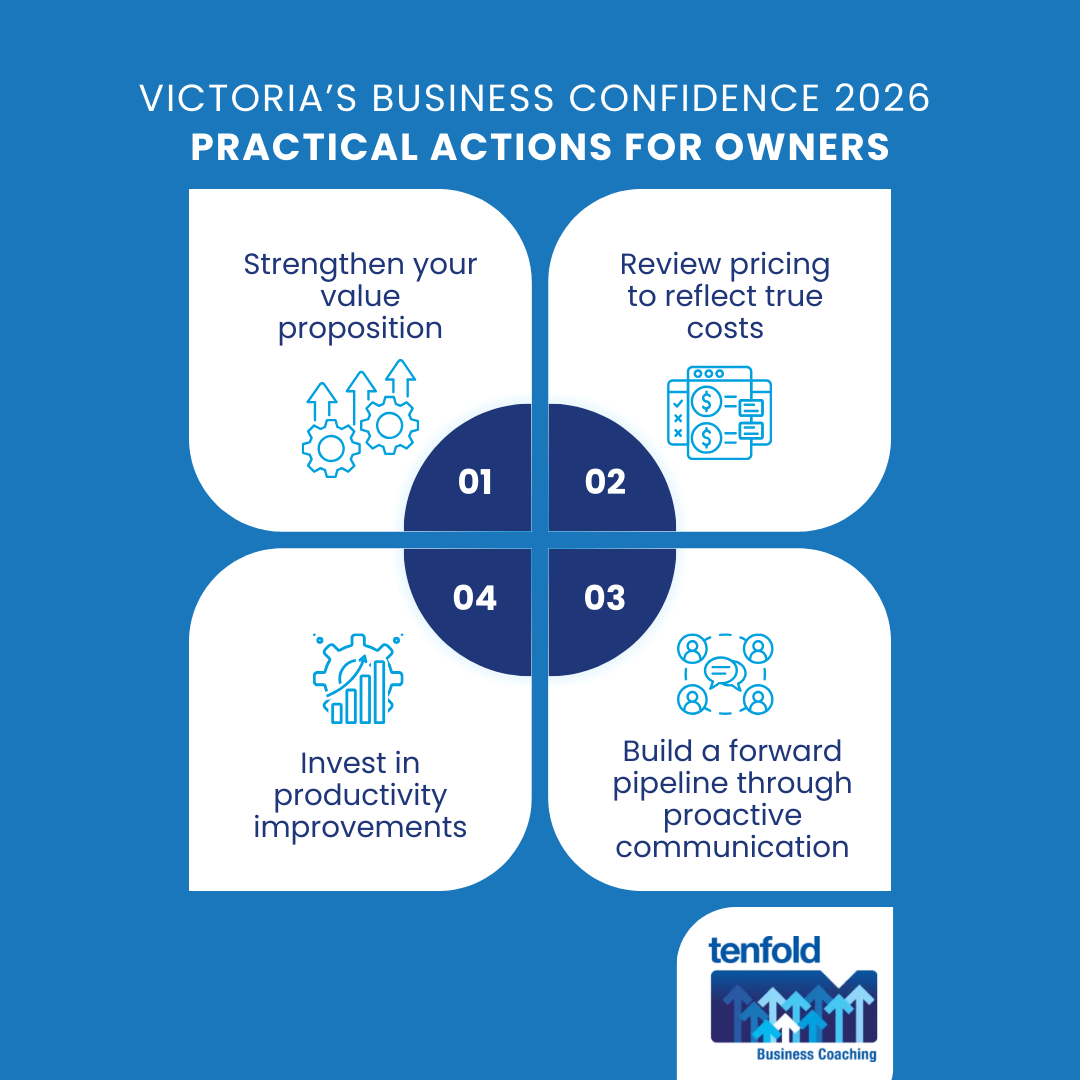

Practical Actions for Owners in 2026

Strengthen your value proposition

Clients are choosing reliability over the lowest price. Businesses that communicate clearly, document thoroughly, and deliver consistently are winning more work. A strong value proposition reduces price pressure and improves conversion rates.

Review pricing to reflect true costs

With wages, materials and overheads stabilising at higher levels, pricing must reflect reality. Businesses that update pricing regularly maintain healthier margins and stronger cash flow.

Invest in productivity improvements

Small improvements in scheduling, supervision, documentation and workflow can deliver significant gains. Businesses that invest in productivity (rather than simply adding labour) are outperforming competitors.

Build a forward pipeline through proactive communication

Clients appreciate clarity. Regular check‑ins, updated capability statements and proactive communication help secure future work and strengthen relationships.

Tenfold Insights: What We’re Seeing Across Victoria

Across the businesses we coach, confidence is strongest in operators who have invested in systems, documentation and financial clarity. These businesses are making decisions based on data, not guesswork. They’re pricing accurately, forecasting effectively and selecting jobs strategically.

We’re also seeing that businesses with strong internal systems are attracting better clients. In a cautious environment, clients gravitate toward operators who demonstrate professionalism, reliability and stability.

Confidence Is Steady and Strong Operators Are Well Positioned

Victoria’s business confidence in 2026 is not exuberant, but it is stable and improving. Investment intentions are rising gradually, hiring is measured but positive, and demand in construction and manufacturing remains steady. The businesses that thrive in this environment are those that plan proactively, price accurately and invest in productivity.

As a business coach working with Victorian trades, builders and manufacturers for over 20 years, I’ve seen how confidence grows when owners have strong systems and clear visibility. If you want support building a more resilient, confident and strategically focused business, learn more about how Tenfold’s business coaches work one‑on‑one with owners through our business coaching services.

Table of Contents

- Confidence Is Cautious, Not Collapsing

- What Business Confidence Really Measures

- How Confidence Is Shaping Investment Intentions

- What Confidence Means for Hiring Intentions

- How Confidence Influences Demand in Construction

- How Confidence Influences Demand in Manufacturing

- Why Confidence Matters for Pricing and Margins

- Practical Actions for Owners in 2026

- Tenfold Insights: What We’re Seeing Across Victoria

- Confidence Is Steady and Strong Operators Are Well Positioned