A Business Coach Explains 4 Australian Business Taxes

If you don’t really understand all of the different taxes you pay, you’re not alone; many business owners don’t know.

It’s very common that a business owner will receive a statement from the ATO or their state tax office (e.g., State Revenue Office in Victoria, Revenue NSW, or Office of State Revenue in Qld) and simply make the payment without knowing exactly what it’s for.

Sometimes the bookkeeper or accountant will get the statement and forward it on to the business owner for payment. But many accountants don’t invest the time with their clients to explain what the charges relate to and how they’ve been calculated. Or when the accountant does make an effort to educate, they explain it in such a technical manner that the explanation isn’t understood.

Last year, many Australian small businesses received government support during COVID by way of tax credits, waivers and deferrals, and wage subsidies. With many businesses no longer receiving government support, the re-appearance of tax bills may be unexpected and/or misunderstood and cause a challenge to your cashflow.

If you haven’t planned for the taxes, they can come as a shock and upset other plans you had for the funds in your bank account.

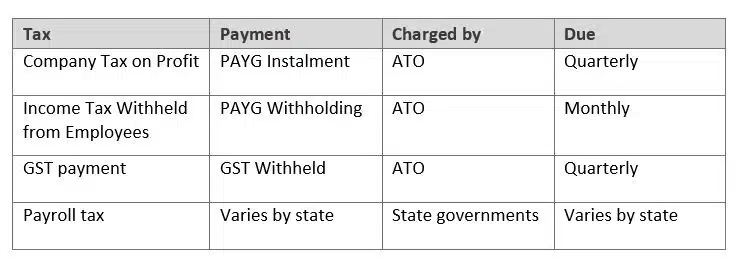

In this briefing, as I have done over the last 12 months, I’ll demystify the detail and help you be informed so you can remain in control. I’ll explain these 4 common taxes:

- Company tax on profits (PAYG Instalment),

- Income tax withheld from employees (PAYG Withholding),

- GST withheld, and

- Payroll tax

I hope this helps your understanding, and I encourage you to speak to your Tenfold business coach if you have any questions or would like further help understanding how these aspects relate to your specific business.

Please note, this isn’t tax advice. It is written in general educational terms, and it is based on the size and structure of the typical Tenfold client. Different businesses and company structures may vary on their tax treatment. If you’re a running a larger business, you’ll generally need to make payments more frequently than the example in this briefing. And if you’re a smaller business, you’ll need to make payments less frequently.

Tax: Company Tax on Profits

Payment: PAYG Instalments

Form: Tax Return

Tax collector: ATO

As the name says, this is a tax on your company profits. It is charged at a flat rate of 27.5% of the net profit you make (the old rate was 30%, prior to 1 July 2020).

Tax is payable based upon the net profit you declare on the annual financial returns prepared by your accountant and submitted to the ATO through your company tax return after the end of the financial year.

But, there’s more to it. Because it can take up to 11 months for some companies to submit their financial returns, the ATO doesn’t want to wait that long for the funds. So, they ask you to pay the tax in instalments throughout the year that you’re making the profits. When you submit the annual financial returns for your company, the ATO estimates what your next year’s profit might be and begins charging tax each quarter. The ATO are effectively charging you during the year for the profit they expect you will declare at the end of year.

Hint: You can vary the instalment amount you pay, but be careful not to under-pay your instalments, then declare a larger profit at the end of the financial year. That will give you a much larger lump sum tax bill and may alert the ATO that you’re manipulating your payments.

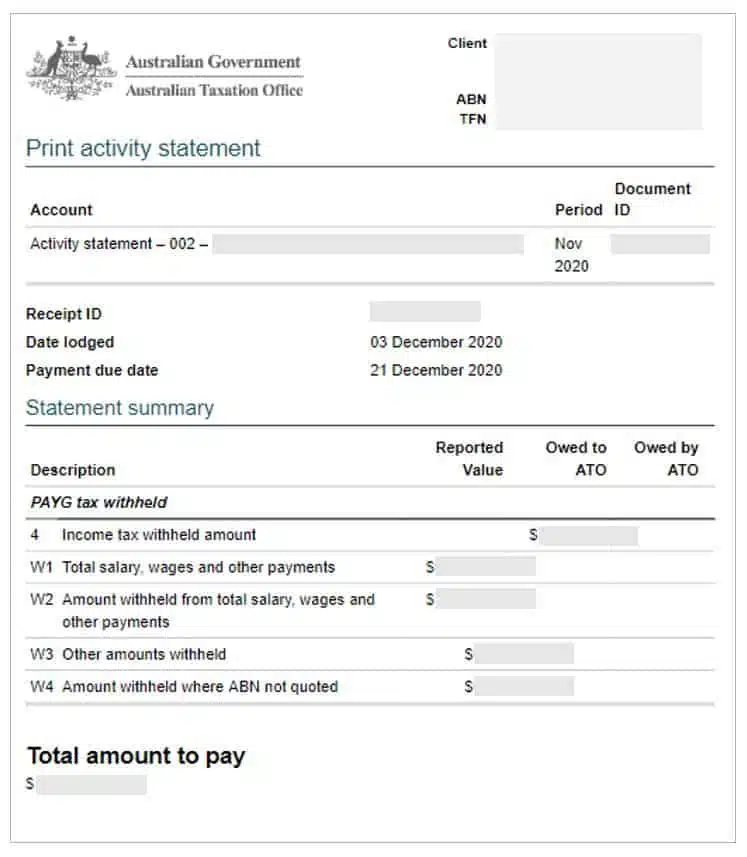

Example of PAYG Instalment Statement:

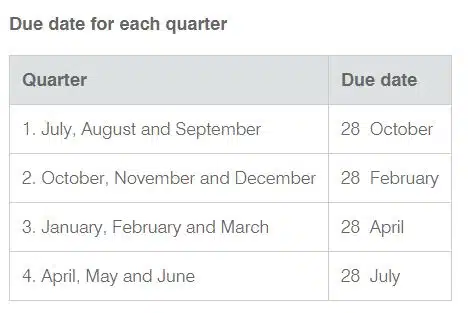

Due dates for PAYG instalments in FY2020-21:

See: https://www.ato.gov.au/business/payg-instalments/

Tax: Income Tax Withheld from Employees

Payment: PAYG Withholding

Form: Instalment Activity Statement – IAS

Tax collector: ATO

Each week or fortnight when you run your payroll and pay your employees, you calculate how much tax they as individuals are due to pay the ATO (for their Pay as You Go income tax [PAYG]). As the employer, you withhold that amount so you can deliver it directly to the ATO.

Most small businesses will receive an IAS two out of the three months in a quarter. The other month they will pay their PAYG Withholding through their BAS. Generally, you’ll have until the 21st of the following month to make the payment.

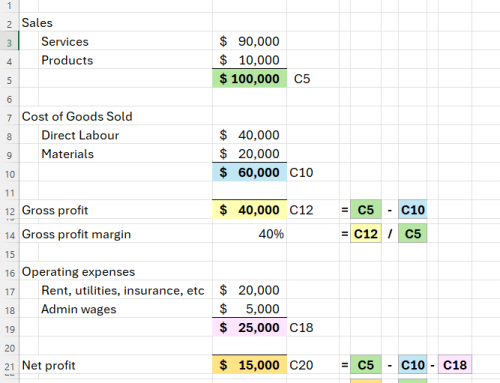

Example of an Instalment Activity Statement – IAS:

Tax: GST Payments

Payment: GST Withheld

Form: BAS

Tax collector: ATO

GST payments are made based on the difference between the GST you collected from clients via your invoices and the GST you paid on general products and services you purchased.

Most businesses will have collected more GST than they have paid and will have to pay the excess to the ATO. Each quarter (or month, if your revenue is more than $20M pa), you’ll have to submit a Business Activity Statement and make a payment.

Also be aware that you’ll also make the payment as part of your BAS for the PAYG Withheld for the last month in quarter.

It is also important to know whether you are registered to calculate your GST based on accruals or cash. Smaller businesses are generally registered on a cash basis, which means that they calculate their GST received and GST paid based upon the money they have physically paid out from their bank account or received into their bank account.

Larger businesses are generally registered on an accrual basis and this means that they calculate the GST received based on the GST value of the invoices they have raised in the quarter, and calculate the GST paid based upon the GST value of the invoices received from suppliers in the quarter.

In certain circumstances you can chose the method you will use, and there are pros and cons to each method.

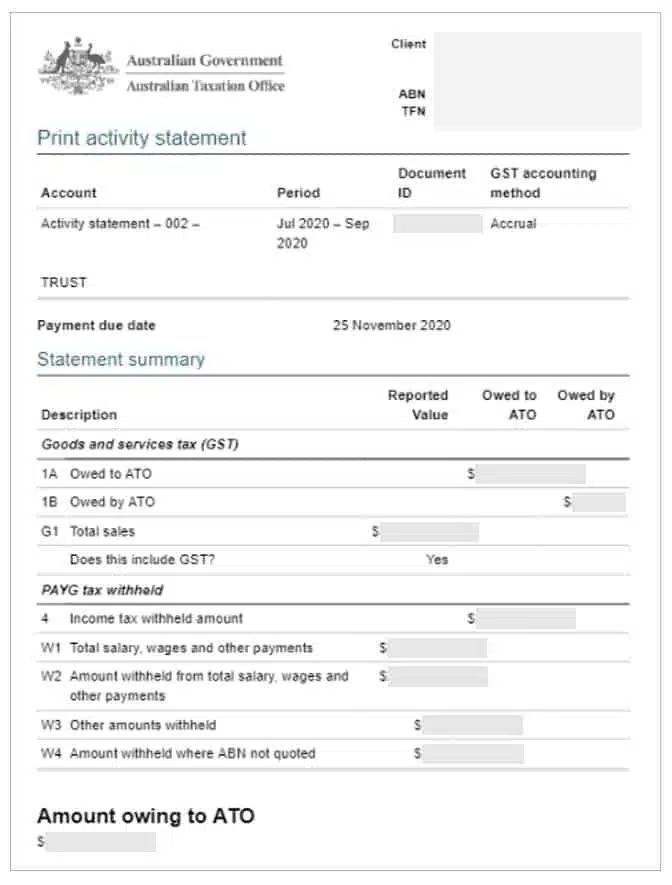

Example of a BAS statement, including PAYG tax withheld:

Due dates for lodging and paying BAS in FY2020-21:

Tax: Payroll Tax

Payment: Payroll Tax

Form: varies by state

Tax collector: each state’s revenue office

This is a tax levied on your payroll above a set threshold, and is charged on a state-by-state basis. Employers pay it based on the payments you have made to employees who are located in that state.

The calculation also varies significantly between states. Victoria generally charges the highest rates of payroll tax and has the lowest threshold (which means you start paying tax sooner), whereas for our Brisbane business owners, Queensland generally charges the lowest rate and has higher thresholds. For example, in Victoria payroll tax is charged at 4.85% of every dollar of wages you pay over $650,00 per annum, where QLD charges 4.75% over the threshold of $1.3m.

This tax is payable either monthly or annually. Many Victorian businesses have benefited by the move by the Victorian government to extend the eligibility for small businesses to pay annually in arrears – see my briefing of 29 July 2020.

Summary of 4 Main Australian Business Taxes

Business taxation is a complex matter, and I’ve only briefly touched on the headline items here. I trust this will help you understand and prepare for the tax bills that might come your way. Again, if you’d like to get more detail about these or other taxes, please speak with your coach at Tenfold and we can help you source the information you need.

Ashley Thomson B.Eng. (Hons), Grad. Dip. Mgmt, MEI

Managing Director

Tenfold Business Coaching

—————————————————————————-