Victoria’s Input Costs 2026: Materials, Energy and Fuel Pressures for Trades, Builders and Manufacturers

This article is part of Tenfold’s Victoria’s Economy 2026 series for owners in construction, trades and manufacturing. In the opening article, I set the scene on Victoria’s broader economic backdrop: moderate growth, uneven demand, and households still under pressure. This instalment focuses on input costs (materials, energy and fuel) and what they mean for your pricing, cashflow and capacity decisions as you plan for 2026.

As a business coach working with Victorian trades, builders and manufacturers every day, I see the real-world impact of cost volatility on margins. This article breaks down the current cost environment (as of late 2025), what’s likely ahead in 2026, and the practical steps I advise owners to take to stay commercially strong.

The Cost Pressures Shaping 2026

Input costs remain one of the biggest operational pressures for Victorian trades, builders and manufacturers heading into 2026. While the extreme spikes of 2021-2023 have eased, the new reality is structurally higher baseline costs across materials, energy and fuel. ABS Producer Price Index data shows materials inflation stabilising but not reversing; AEMO and ACCC reports confirm elevated wholesale energy prices; and fuel remains volatile due to global supply constraints and geopolitical risks.

For business owners, this environment demands disciplined pricing, tighter job costing, and stronger forward visibility on supply and energy contracts. At Tenfold Business Coaching, we’re seeing the most resilient operators use structured review cycles, supplier diversification, and proactive client communication to protect margins.

This article breaks down the cost drivers, the 2026 outlook, and the practical steps to maintain profitability. It’s written for Victorian trades, builders and manufacturers who need clear, commercially grounded guidance – not economic theory.

Materials Costs: Stabilised but Still Elevated

Material costs have stopped rising at the extreme rates seen during the pandemic and early recovery period, but they remain structurally higher than pre‑2020 levels. According to the ABS Producer Price Index (Building Construction Inputs), materials inflation in 2024–2025 has flattened, but prices have not fallen back to earlier baselines.

What’s driving the current level?

- Global supply chains have normalised, but freight costs remain above pre‑COVID averages.

- Domestic manufacturing capacity constraints continue to affect steel, fabricated metal, and precast products.

- Demand pockets remain strong, particularly in infrastructure and commercial fit‑out, keeping pressure on certain categories.

- Commodity prices (steel, copper, aluminium) remain volatile due to global demand and geopolitical tensions.

What this means for Victorian trades and builders

For electrical, plumbing, HVAC, concrete and landscaping contractors, the biggest challenge is margin erosion through slow price updates. Many operators still quote using outdated cost assumptions.

At Tenfold, we see this pattern repeatedly:

Owners assume “prices have stabilised” means “prices have returned to normal”. They haven’t.

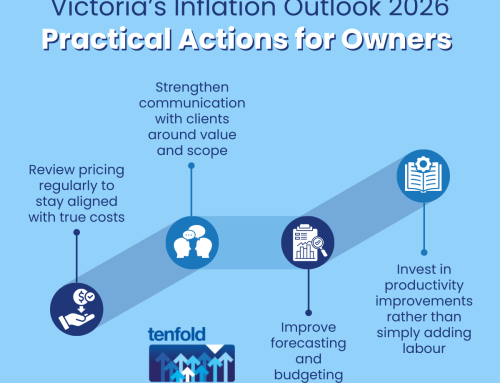

Practical actions for 2026

Implement a quarterly pricing review cycle

This is now a non-negotiable.

- Update labour rates, materials allowances and overhead recovery.

- Reprice standard assemblies (switchboards, rough-ins, slab prep, ductwork, etc.).

Use rolling 90-day supplier quotes

Lock in pricing where possible, especially for:

- Steel

- Copper cabling

- Timber

- Concrete

- HVAC units

Build escalation clauses into contracts

Especially for custom builders and commercial trades with long lead times.

Improve job costing discipline

The strongest operators we coach track:

- Variance between estimated vs actual materials

- Supplier price changes by category

- Gross margin by job type

This is the difference between a 12% net profit and a 4% net profit in the current environment.

Energy Costs: Elevated and Volatile

Energy remains one of the most significant cost pressures for Victorian manufacturers and fabrication businesses. AEMO’s 2024-2025 reporting shows wholesale electricity prices easing from their 2022 peaks but still well above long-term averages. Gas prices remain elevated due to east-coast supply constraints and export-linked pricing.

What’s driving energy costs?

- Delayed renewable generation projects and transmission constraints.

- High gas demand from industrial users and a limited domestic supply.

- Network investment costs are being passed through to end users.

- Weather volatility is affecting peak demand periods.

Impact on Victorian manufacturers and fabricators

For metal fabrication, joinery, plastics, food processing and other energy-intensive operations, electricity and gas can represent 8–20% of total operating costs.

At Tenfold, we see three common issues:

- Businesses are stuck on outdated retail contracts.

- Poor visibility of peak vs off-peak usage.

- Underinvestment in energy efficiency because owners are time-poor.

Practical actions for 2026

Review your energy contract before expiry

Many Victorian SMEs are rolling onto default market offers that are 15-30% higher than negotiated rates.

Conduct a usage profile analysis

Most manufacturers don’t know their peak demand charges. This is where savings often hide.

Invest in efficiency with short payback periods

Examples we see delivering ROI within 12-24 months:

- LED upgrades

- Variable speed drives

- Compressed air leak detection

- Insulation improvements

- Solar for daytime-heavy operations

Consider load shifting

For businesses with flexible production windows, shifting even 10-20% of load out of peak periods can materially reduce bills.

Fuel Costs: Volatile and Hard to Forecast

Fuel remains one of the most unpredictable input costs for Victorian trades and construction businesses. ACCC monitoring shows petrol and diesel prices fluctuating significantly due to global supply constraints, refinery outages, and geopolitical tensions.

Why fuel volatility matters operationally

For trades and builders, fuel affects:

- Service vehicle fleets

- Delivery of materials

- Plant and equipment transport

- Subcontractor pricing

For manufacturers, fuel impacts freight, logistics and inbound supply chain costs.

What we’re seeing across Tenfold clients

- Businesses with large service areas (regional Victoria, outer metro) are most exposed.

- Operators with older fleets face higher maintenance and fuel inefficiency.

- Many owners still don’t charge a fuel levy or haven’t updated it since 2022.

Practical actions for 2026

Introduce or update a fuel levy

This is standard practice in commercial contracting and maintenance.

Tighten service area boundaries

We’ve helped clients reduce unproductive travel by 10–25% simply by redrawing zones.

Improve route planning

Even small improvements in scheduling can reduce fuel consumption.

Review fleet replacement strategy

Fuel-efficient vehicles often deliver ROI faster than expected when fuel is volatile.

Supply Chain Pressures: Not Broken, But Not Back to Normal

While supply chains have improved since 2023, they haven’t returned to pre‑COVID reliability. Lead times for certain categories remain extended, especially:

- HVAC units

- Switchboards

- Custom metal fabrication

- Imported fixtures and fittings

- Solar components

What this means for 2026 planning

Longer lead times push up your working capital requirements, because you’re carrying materials and commitments for longer before you can invoice. Those delays then flow straight into scheduling inefficiencies – crews waiting on materials, jobs starting later than planned, and knock‑on effects across the pipeline. At the same time, clients expect faster turnaround than suppliers can realistically deliver, which increases pressure on your timelines and team.

At Tenfold, we coach owners to build realistic lead-time assumptions into their scheduling and cashflow planning.

How to Protect Margins in a High-Cost Environment

This is where the rubber hits the road. Input costs are only a problem if your pricing, quoting and operational systems don’t keep up.

Strengthen your pricing model

Every business should have a documented pricing model that includes:

- Labour recovery rates

- Overhead allocation

- Materials mark-up

- Risk margin

- Fuel and travel allowances

If you don’t have this, you’re guessing.

Improve forward visibility

Use a 6–12 month forecasting model to track:

- Materials cost trends

- Energy contract expiry

- Fuel levy adjustments

- Supplier lead times

This is standard practice for the highest-performing operators we coach.

Communicate proactively with clients

Clients accept cost increases when they’re explained clearly and early. They push back when increases appear sudden or arbitrary.

Strengthen supplier relationships

In 2026, the best pricing won’t always go to the lowest-volume buyer; it will go to the most reliable partner.

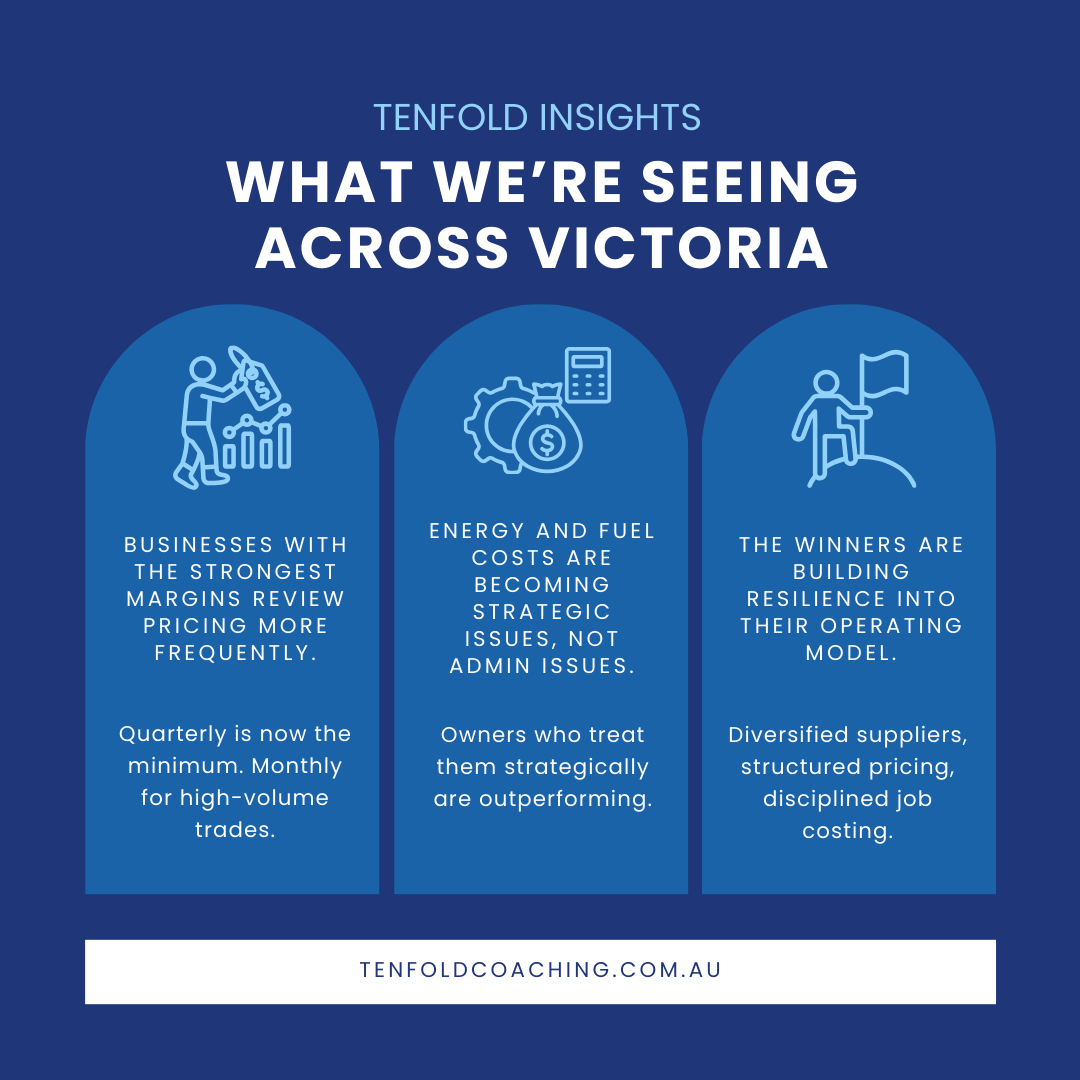

Tenfold Insights: What We’re Seeing Across Victoria

Across the trades, construction and manufacturing businesses we coach, three themes stand out:

Businesses with the strongest margins review pricing more frequently.

Quarterly is now the minimum. Monthly for high-volume trades.

Energy and fuel costs are becoming strategic issues, not admin issues.

Owners who treat them strategically are outperforming.

The winners are building resilience into their operating model.

Diversified suppliers, structured pricing, disciplined job costing.

This is the new normal for Victorian SMEs.

Conclusion: Build a Cost-Resilient Business for 2026

Input costs in Victoria aren’t going back to pre‑2020 levels. Materials have stabilised but remain high. Energy is elevated and volatile. Fuel is unpredictable. For trades, builders, and manufacturers, the businesses that thrive in 2026 will be those that price accurately, plan proactively, and manage risk deliberately.

As a business coach working with Victorian SMEs for over 20 years, I’ve seen how disciplined systems protect margins even in tough environments. If you want support building a more resilient, profitable business, learn more about how Tenfold’s business coaches work one-on-one with owners through our business coaching services.