Why ROAS is a Dud Metric (and What Trades Businesses Should Use Instead)

If you’ve ever received a glowing report from your ad agency showing a high ROAS, you’re not alone. ROAS (Return on Ad Spend) is the go-to metric for marketers to showcase campaign success. It measures how much revenue is generated for every dollar spent on advertising. For example, a ROAS of 4.0 means $4 in revenue for every $1 spent.

Sounds impressive. However, for trade businesses (such as builders, electricians, plumbers, and landscapers), ROAS is a dangerously misleading metric.

Why? Because ROAS only tells you how much money came in, not how much you actually kept. It completely ignores the real-world costs of delivering the work. And in trades, those costs are significant: labour, materials, subcontractors, equipment, fuel, and compliance. Then there are indirect costs, such as rent, insurance, vehicle leases, training, and uniforms.

Advertising agencies love ROAS because it makes their campaigns look good. But for trades businesses operating on tight margins, revenue is not the goal. Profit is. Revenue doesn’t pay wages, cover overheads, or fund growth. Only profit does.

Why ROAS Misleads Business Owners

ROAS is a top-line metric. It measures revenue, not profitability. That’s a critical distinction to keep in mind when evaluating the success of your advertising efforts.

Let’s say your campaign generates $10,000 in revenue from $2,000 in ad spend. That’s a ROAS of 5.0. But what if the job costs (labour, materials, subcontractors) total $7,000? That leaves you with $3,000 in gross profit. Now your real return is 1.5, not 5.0. It’s important to understand that ROAS does not account for these important cost factors.

ROAS ignores the cost of doing the work. And in trades, those costs can vary wildly depending on the specific job. A campaign might generate lots of leads, which is good, but if those jobs are low-margin or high-cost, you could be losing money while still thinking you’re winning.

This disconnect can create false confidence among business owners. Seeing a high ROAS might lead them to assume that their marketing campaign is working effectively. Consequently, they may decide to scale up ad spend, expecting even more revenue. But without a clear understanding of the actual profitability of those leads, they risk burning cash on unprofitable work that does not contribute to sustained business growth.

ROAS can also lead businesses to chase volume instead of margin. Prioritising high volume without considering profit margins can be a fast track to cash flow problems and financial instability. It’s crucial to look beyond simple revenue metrics and evaluate the true profitability of your campaigns to make smarter, more informed decisions.

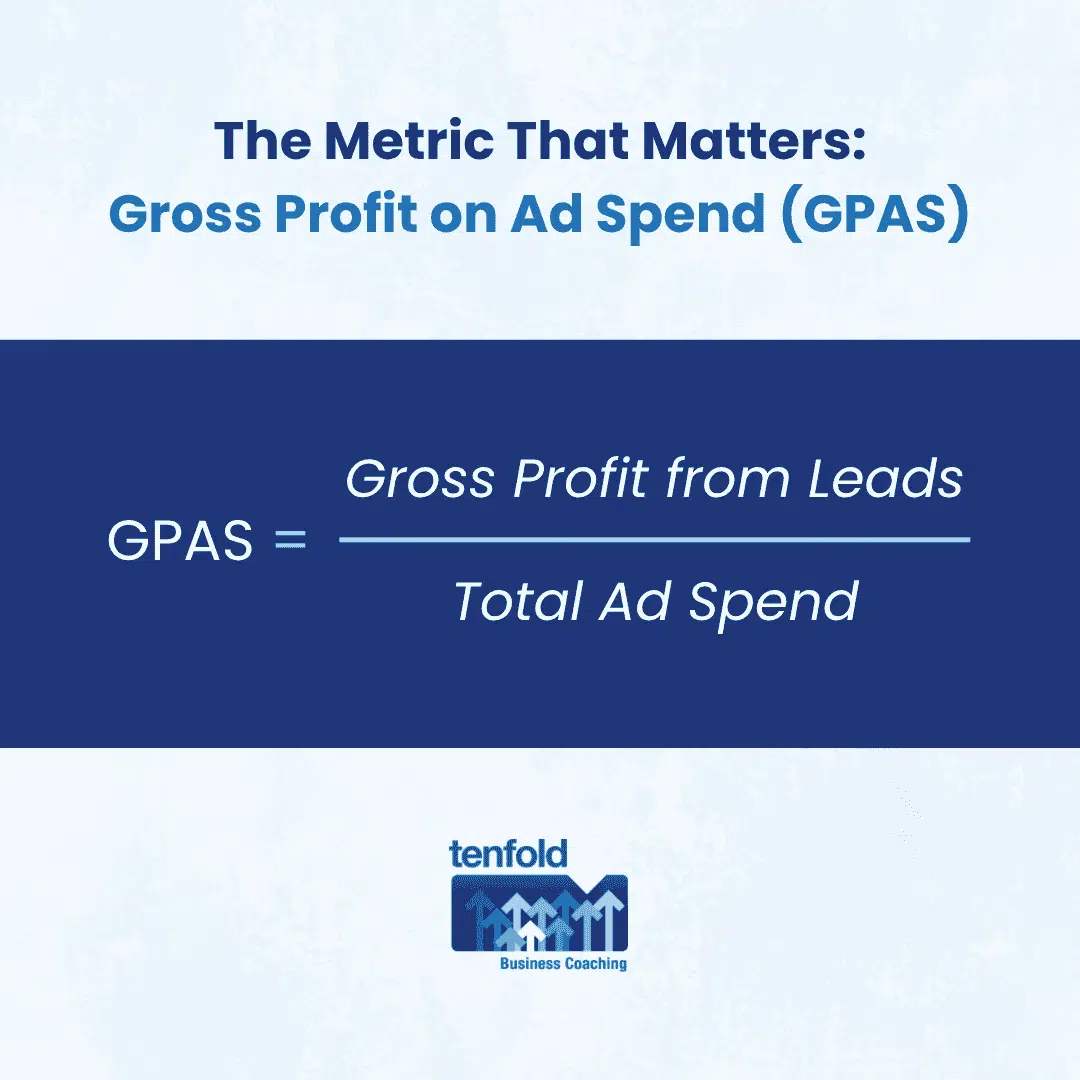

The Metric That Matters: Gross Profit on Ad Spend (GPAS)

To make smarter marketing decisions, trade businesses need a better metric. That metric is GPAS, which stands for Gross Profit on Ad Spend.

GPAS measures the gross profit generated for every dollar spent on advertising. It takes into account the cost of goods sold, providing a true reflection of marketing efficiency. By understanding this, business owners can gain clearer insights into how their advertising dollars truly impact profitability.

The formula is simple: GPAS = (Gross Profit from Leads ÷ Total Ad Spend)

This calculation reveals the actual amount of money left over to cover overhead expenses and generate real profit.

Focusing on GPAS shifts attention away from vanity revenue figures and toward genuine profitability. It enables business owners to identify which lead sources are genuinely contributing to profitable growth, helping them make more informed marketing decisions. Additionally, monitoring GPAS supports better cash flow management, as it encourages not just chasing jobs but pursuing those that deliver healthy margins and lasting value.

Example: ROAS vs Gross Profit ROAS

Let’s break it down with a detailed real-world example to understand it better.

Your ad agency runs a Google Ads campaign costing $1,000. They report that this campaign generated $2,000 in revenue. From this, the ROAS (Return on Ad Spend) is 2.0. On paper, it looks like a successful campaign and a win.

However, it’s important to now consider your gross margin. Suppose your gross margin is 44%, which is quite typical for many trade businesses. That means the gross profit earned from the jobs generated by the campaign is $880.

Now, let’s calculate GPAS (Gross Profit Ad Spend):

GPAS = $880 ÷ $1,000 = 0.88

This means for every dollar spent on Google Ads, you only made about 88 cents in gross profit. And this is where the real story becomes clear. This isn’t a profitable campaign. It’s actually operating at a loss. If you had scaled this campaign solely based on ROAS, you would have risked digging an even deeper financial hole.

This example illustrates why Tenfold Business Coaching instructs clients to prioritise GPAs as their primary metric. It provides a more accurate understanding of profitability and the true effectiveness of advertising efforts, making it the only metric that tells the complete story.

Why Gross Profit on Ad Spend Gives Better Insight

GPAS is the metric that aligns marketing efforts closely with operational goals. It encourages collaboration between the estimator, marketer, and operations manager, fostering a team environment where everyone is working toward the same overarching goal of profitable growth. By working together, these roles can create more coordinated and effective strategies, ensuring that every department’s efforts contribute to the bottom line.

Additionally, GPAS helps allocate resources in a more strategic and effective manner. Instead of simply investing money into advertising channels that may generate high revenue but produce low profit margins, businesses can focus on channels that yield strong gross profit. This might involve shifting advertising spend from platforms like Google Ads to search engine optimisation efforts or reallocating funds from Facebook ads to referral programs. The key point is that making these decisions based on profit metrics rather than vanity metrics leads to better financial outcomes.

GPAS also supports smarter scaling of marketing efforts. When you have clear data showing which campaigns are delivering strong gross profit, you can confidently increase spending on those campaigns. This removes the guesswork from scaling and allows for investments in strategies that truly work, thereby maximising return on investment.

In tradie business coaching, adopting GPAS represents a major transformation. It shifts the perspective of marketing from being merely a cost centre to becoming a genuine profit driver, ultimately helping businesses grow more efficiently and sustainably.

Final Thoughts from a Tradie Business Coach

Marketing should be a tool for growth, not a source of confusion. ROAS might look good on a report, but it doesn’t tell you what you need to know. GPAS does. It’s the metric that cuts through the fluff and shows you what’s really working.

For trades businesses, where margins matter and job costs fluctuate, GPAS is essential. It helps you invest wisely, scale safely, and grow profitably. That’s what Tenfold Business Coaching is all about.

If you’re ready to take control of your marketing and make decisions based on profit, not promises, start tracking GPAS. It’s the smartest move you’ll make this quarter. Contact us to learn how to start tracking the right metrics today.

FAQs from a Tradie Business Coach

What’s a good Return on Ad Spend (ROAS) for a trades business?

There is no universal benchmark that applies across all situations. It’s important to remember that a campaign showing a high ROAS can still result in a loss if the costs associated with each job are high. Therefore, it’s more reliable to always measure Gross Profit on Ad Spend (GPAS) instead of just ROAS.

How do I calculate Gross Profit on Ad Spend?

To do this, take the total gross profit (which is revenue minus the direct costs of the jobs generated) from leads that came through that specific advertising source. Then, divide this amount by the total advertising spend for that source. This calculation provides a clearer picture of the true profitability of your advertising efforts.

Can I use ROAS and GPAS together?

Yes, you can. Use ROAS to gauge top-line performance, providing a sense of revenue generated relative to ad spend. Meanwhile, use GPAS to assess the actual profitability after accounting for direct job costs. However, when making important business decisions, it’s advisable to base them primarily on GPAS because it better reflects true profit margins.

How often should I review ad performance using GPAS?

For trades businesses, reviewing your ad performance quarterly tends to be the most effective approach. This frequency aligns well with the typical length of sales cycles in the trades industry, allowing enough time for costs to settle and providing accurate and meaningful insights.

What should I do if my ad agency doesn’t provide cost data?

In this situation, ask for lead and revenue data only from your agency. Then, apply your internal gross margin percentage to these figures to calculate the real GPAS. This approach keeps your agencies accountable and ensures that your decision-making remains grounded in actual profitability.

![Account-Based Marketing (ABM) for Contractors: Connect with Facilities & Property Managers [Template, Examples, Checklist]](https://tenfoldcoaching.com.au/wp-content/uploads/2025/09/Account-Based-Marketing-ABM-for-Contractors-Connect-with-Facilities-Property-Managers-Template-Examples-Checklist-500x383.png)