Offering your team a company car: is it the right decision for your business?

As a business coach, I am seeing increasing numbers of business owners grappling with whether not to offer their team the use of a company car.

As a business coach, I am seeing increasing numbers of business owners grappling with whether not to offer their team the use of a company car.

There are a few reasons you might consider offering access to a work vehicle to an employee, including:

- It can help them do their job more effectively – especially if travel is an inherent requirement of their role (ie tradespeople, salespeople, consultants etc). It may also solve access issues related to your location, eg lack of reliable public transport etc.

- A company car can be an attractive non-cash perk that could position you as an employer of choice (helping you attract and retain top talent in your business).

- There may also be promotional benefits should you decide to deck the cars out in company branding. With your logo, phone number and website splashed across the doors or rear windscreen, that work vehicle just became a rolling billboard for your business.

However, there is more to managing a fleet of company vehicles than picking out your paint colour and handing over the keys.

There are some tough questions to answer: How do you decide who needs/gets use of a work car? Have you considered all the costs involved? What about FBT? How should you allow employees to use them?

I mentor business owners to make sure they consider all angles of this decision before jumping on the company car bandwagon (pun intended).

Who should get a company car?

There are several factors that may affect your decision to provide a work car for certain team members:

Employee performance

You may choose to link the offer of a work vehicle to reaching (or exceeding) established Key Performance Indicators (KPIs), eg achieving a certain amount in sales for the business.

Your vision for the business

There are two points to consider here:

- A fleet of branded and/or well-maintained vehicles for your team members to present in when attending client sites projects an image of professionalism and success.

- Growing your business relies upon attracting and retaining the best talent. As you become a bigger player in your market, you will be competing at a higher level to assemble your dream team. This means non-cash perks will need to become a part of your remuneration package.

The team member’s role in your future org chart

Is your team member likely to stay long enough in the business to justify the expense, eg are they being trained up to become a manager, or to take over a key function within the business?

The impact on other team members

How will offering some team members (and not others) a company vehicle change your team culture. It may take a flat structure and suddenly create a new layer of seniority. That may well work for your business, but it’s something to keep in mind.

Remember to factor in the ongoing costs

Buying a car for company use is a long-term strategic decision, not just a one-off purchase. Cars have running costs, are depreciating assets and will eventually need replacing. If a car is a company vehicle, then you are responsible for registration, insurance, maintenance, and repairs in the event of an accident.

Don’t forget FBT

There are certain exemptions from FBT for some businesses. If you are considering purchasing a company car for your team to use, you should seek advice on whether your business is eligible.

Where Fringe Benefit Tax (FBT) applies, since it is set at a percentage rate that is often much higher than your employee’s marginal tax rate, it may seem counter-intuitive for business owners to offer a company car. However, there are a lot of factors to take into account, including how the taxable value is calculated – especially since FBT only applies to personal use.

There are two ways that the ATO calculates the taxable value of a car fringe benefit:

- Logbook method – basically you keep an official record over a period of 12 weeks, detailing the use of the car. Every time your employee gets behind the wheel, they’ll need to take note of the purpose of the trip, whether it was for work-related or personal use and the distance travelled (in km). While it’s a lot of admin initially, once that 12-week data sample is completed, it can be used for up to five years to establish the percentage split of personal vs work-related use for tax purposes. This is often the best formula to use if the car is mainly used for work purposes.

(NB: the travel between work and home is generally considered personal use for tax purposes. There are, however, some exceptions. Your accountant will be able to provide clear definitions around personal vs work-related use as it applies to your situation.)

- Statutory Formula – the ATO allows another approach where a flat rate of 20% of the car’s base value (ie purchase price, less stamp duty and registration costs) is nominated as ‘for personal use’. This formula works best when the car is offered primarily as a retention strategy and is mainly used for personal travel. The flat rate approach in this case would offer an advantage over the logbook method, since little work usage would be recorded.

NB: There are other factors (ie the type of vehicle your offer and employee contributions etc) that will affect the financial impact of a company car scheme on your business and your employees. Always seek expert financial advice to determine what options best suits your needs.

Access the ATO’s guide to car fringe benefits tax

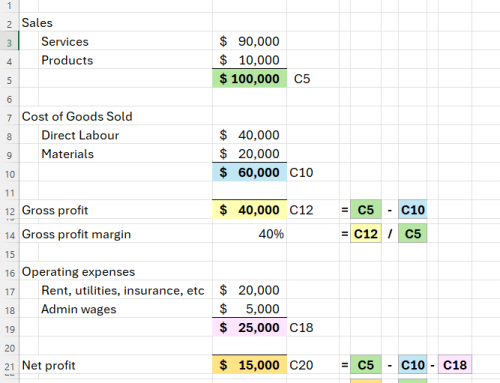

Pro Tip: While we’re on the topic of taxes, don’t fall into the trap of confusing a tax write-off with actual income. When you purchase a company car it’s still a cost for your business, even taking into account the tax benefits.

Make things clear with a policy

If you do decide to introduce a company car scheme in your business, you must establish ground rules around ownership, responsibilities and usage by way of a company policy. This document should clearly outline who bears the maintenance and running costs, what is considered ‘reasonable use’, who is responsible for record-keeping (regarding usage) and who can drive the vehicle etc.

Should you give company vehicles the green light?

With an increasingly mobile workforce, the topic of company vehicles comes sharply into focus for business owners. While there are benefits in terms of employee retention and business promotion, there are several financial and other factors to consider. As a business coach, I mentor my clients to think strategically about going down this road and recommend that they seek professional advice to ensure that they make the right decision for their business.

—