Using cost benefit analysis to make solid investment decisions for your business

The adage is true: you must spend money to make money. It’s a red-letter day when your business is profitable enough that you can start investing in its growth.

The adage is true: you must spend money to make money. It’s a red-letter day when your business is profitable enough that you can start investing in its growth.

But in my time as a business coach I have seen many business owners struggle to work out the best way to invest this resource; often it’s a case of new level, new devil.

There are so many ways you could choose to spend some extra cash: do you take on more staff or lease a new premises, purchase equipment or a company car, boost your marketing efforts, train up your staff or focus on personal development or business coaching?

Managing cash-flow is, of course, a huge issue for business owners and that means making smart financial decisions. How do you work out which investment will be the thing that takes your business to the next level (thus justifying the expense)?

Five questions to ask before you open your wallet

Q1: Where do I want to be in five years?

As a business coach, I mentor business owners to make intentional and strategic financial decisions that will help them to achieve their long-term goals. By first working out where you want to end up, you can reverse-engineer the journey (making investment decisions more focused).

Q2: Will this help me make money

If the answer is “No”, then consider the investment carefully.

I coach business owners to understand strategic vs non-strategic expenses. Strategic investments will boost sales or productivity, ie effective marketing campaigns, sales team, tech or equipment upgrades. Almost anything else is non-strategic.

It is important to always prioritise strategic investments over non-strategic ones, especially in a newer or smaller business where budgets are much tighter.

Once you have all your strategic expenses covered, that’s the point at which you might splash out on that new company car.

Q3: What business problem could I potentially solve?

What are the roadblocks stopping you taking your business to the next level? If your business needs more customers to grow, then marketing and lead generation is the place to invest. If, however, you are struggling with capacity (ie turning work away), then extra staff may end up being the better spend.

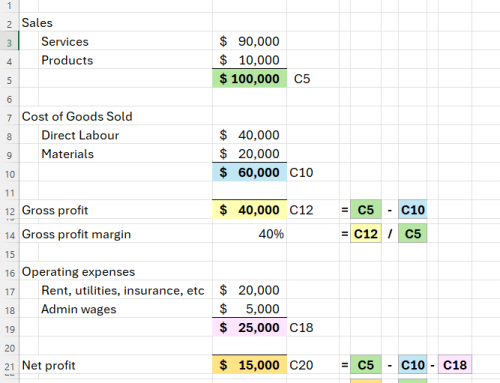

Q4: What do the numbers tell me?

It’s important to base any financial decisions in solid data (ie numbers that are complete, accurate and up to date). Furthermore, always track the return on investment (ROI) – that way you’ll know next time whether it’s a strategy worth repeating.

Q5: What would help my customers do more business with me?

Talking with your customers can be a great source of insight into what areas of your business require investment – there’s no one better placed to let you know what they need and want from your business. How did they find you? Was there something that made them hesitate to buy? Did they experience any frustrations that you could solve? Removing the friction-points from your sales funnel (or flywheel) is always a sound strategy.

One tool that makes investment decisions a little easier

If you’re still struggling to choose between several investment options, one tool that, as a business adviser, I recommend my clients use when making business investment decisions is a cost benefit analysis (or CBA).

What is a cost benefit analysis?

In a nutshell, a CBA helps you work out whether the benefits of a particular scenario truly outweigh the costs (and therefore whether you would be making a sound financial investment).

It involves weighing up the positives (usually financial gain in a business setting) against the negatives (or costs) of a particular action.

How to run a cost benefit analysis for your next investment decision

Step 1. Work out your objective – what business problem are you trying to solve with this investment?

Step 2. List (and consider) any alternatives – are there other ways you could solve the business problem from step 1?

Step 3. List all the costs and benefits – make a comprehensive list of all the costs and benefits, remembering to take more than just the dollars and cents into account. There may be opportunity costs to consider; ie if I spend this money on X then I can’t afford Y. There may also be less obvious things to consider (such as social impacts or the cost of your time).

Step 4. Put a dollar value on it – for each of the costs and benefits listed, you will need to work out what each represents in monetary terms. Sometimes this is obvious, but there are less visible values to consider as well. Take, for example a staff training course that costs $1000 per team member. To work out the total cost, you also need to take account of the lost work hours of each staff member attending the course. You would also have to weigh all of that up against the potential increase in revenue that would result from the overall improved skill level.

Step 5. Run the equation to make a comparison – the formula for a cost benefit analysis is quite simple; it is the benefits divided by the costs:

b/c

Let me illustrate this for you with a very simple example:

Say you are looking at installing $500 worth of software on your computer, but you estimate that it’s going to save you $10,000 in lost productivity by automating a time-consuming process, then the formula would look like this:

10,000/500 = 20

If the result is greater than 1, it indicates that the benefits outweigh the costs. The higher the value of the result, the more confidence you can have that the investment makes good financial sense.

See our blog on Tackling Tough Decisions for more decision-making tools

It won’t always come down to just the numbers

A cost benefit analysis can be a great basis for narrowing down your options to see which investments are most likely to deliver a return. However, as a business coach, I always mentor my clients that a CBA always involves at least some assumptions. Take the staff training example above; you could only ever estimate the increase in revenue associated with the improved skills of your team. A CBA is never an exact science, so while numbers often tell a compelling story, your instincts as a business owner should always get a vote on any decision you make.

—