Can I quote you on that? The Tenfold guide to quoting for your small business

Without a plan in place, quoting for a job can feel like playing ‘Marco Polo’. You have a price in mind. The customer has a price in mind. As the business owner, you are left stumbling around blindly searching for a number that keeps everyone happy.

Without a plan in place, quoting for a job can feel like playing ‘Marco Polo’. You have a price in mind. The customer has a price in mind. As the business owner, you are left stumbling around blindly searching for a number that keeps everyone happy.

Your only measure for success in this scenario? Whether or not your potential customer says ‘yes’. Even then, if they seem too enthusiastic about the price, then you may be left thinking ‘should I have quoted more?’

What if you could take the guesswork out of the equation? Our team of business coaches is experienced at mentoring our clients to tighten up their quoting process, so they have more hits than misses.

First up: are you aiming at the right target (market)?

Before you get started, you’ll need to make sure that this potential customer is a good fit for your business. This is important, because if you are targeting the right customers, your ‘yes’ rate is sure to improve.

Ask yourself:

- Can I provide what the customer wants (in terms of products/services, quantities and timeframe)?

Make sure that you really drill down to get a good grip on the scope of what’s involved. This will save you from under-quoting or over-committing yourself (eg ending up needing to hire extra people to get the job done). Even worse is finding out that it isn’t possible to deliver on what you promised, putting your reputation (and future sales) at risk. - Can I charge an amount that the customer is willing to pay and make a profit?

Research your target market to find out what they are willing to pay for similar product or service. You don’t want to price yourself out of a sale or job, but you also don’t want to go too low. Price can be an indicator of quality – some customers can be turned off when an offer seems too good to be true. In terms of profitability, you’ll need to make sure that you cover all your costs and then add a healthy margin. Make sure that you keep records of your costs up to date and that any variables are accounted for.

- Is your selling price competitive?

While it’s important to keep an eye on the competition, always make sure that you aren’t undervaluing your services. Are you comparing apples with apples? For example, bigger businesses may have economies of scale that allow them to offer a lower price. That doesn’t necessarily mean that you should cut yours. Instead, you might ensure that your marketing communicates the value and unique benefits that your business offers – eg a more personalised level of service, or expert local knowledge etc.

Did you answer ‘yes’ to all three questions?

If so, then go forth and quote. Otherwise, you may have to consider turning the job down, or at least clearly communicate any conditions or disclaimers of sale in your quote.

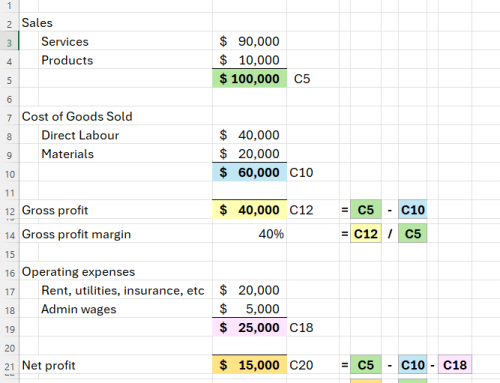

A quick note on Mark-up vs Margins

Many people get this one mixed up – there’s a subtle difference between mark-up and margin:

- Margin is your sales price minus your costs.

- Mark-up is the percentage that you increase your costs by to arrive at your selling price.

Spot the difference? Let’s look at an example:

Say you sell a product for $100.

If your cost on that product is $60, then your margin is $40 (or 40% of the sales price)

Your mark-up is also $40. However, the mark-up percentage is calculated as a proportion of the cost. Therefore, your mark-up of $40 (as a percentage of $60 cost) is 66.6%.

Why does this matter?

You don’t want yourself or your sales team to get these two mixed up. Since the percentages are so different, applying the incorrect percentage to the cost price could result in under-charging for your product or service!

A formula for quoting success

Are you ready…

Labour + Materials + Admin + Overheads + Margin = Selling Price

Simple, yes. But just because something is simple, doesn’t make it easy.

Working out the details: the anatomy of a selling price

Labour – this is a variable cost (which is why knowing the scope of the job is so important). You’ll need to know your hourly rate and how many hours the job is likely to take. You will also need to work out if you need additional hands on the job and adjust the labour cost accordingly.

To work out your hourly rate, start by thinking about how much you need to earn a year to live comfortably. Remember to include other income-related elements such as tax and super, holiday pay and sick leave in this figure. Now divide that number by how many hours you plan to work per year. (Don’t worry we already worked that out for you, remember – its 1,971.) The figure you end up with represents a rough idea of the hourly rate you should aim for.

Materials – you will need to accurately work out which materials you will need for this job and how much of each item is required. It’s always a good idea to maintain an up-to-date record of regularly used materials which you can then pick and choose from as needed. This will make preparing your quote much quicker and easier. Don’t forget to also factor in the cost of time spent selecting, ordering and handling these materials.

Admin – you’ll also need to pay yourself (or any staff or contractors etc) for other tasks performed in your business – ie admin, book-keeping etc. It is common for small business owners to perform these tasks and not pay themselves for their time. As a business coach, I advise against this, since these tasks take time away from core business activities.

Overheads – these are all the other costs that go into keeping your business’s doors open. Rent or repayments on an office or showroom etc, travel costs, utilities, insurances, repairs, depreciations… tea and coffee for the staff room – it’s a long list! be sure to regularly revise and update your records of these costs for accuracy.

NB: Your accountant is the best person to advise how to work out and incorporate your admin and overheads into your quotes. Having these prepared as a flat fee or a percentage that you can simply add on will help you get your quotes out quicker.

So far, we’re only just breaking even on this job. You’ll need to add in some margin so you can reinvest in your business and help it grow…

Margin – This is the only part of your quote that allows for any ‘wriggle room’. You might, for example, reduce the margin to stay competitive in your market or increase the margin because, despite relatively low costs, a job has a high perceived value to your customers.

Consult your business plan to help you decide how much margin you need to apply to each sale in order to achieve your targets.

NB: This is where knowing your mark-up from your margin comes into its own. Once you have established an idea of how much margin you need to make on each sale, you’ll be able to work out your mark-up percentage and simply apply that to your costs to work out your sales price. Easy!

One last thing… don’t forget to add 10% Goods and Services Tax (GST)!

Technology can help you quote faster (and more accurately)

There are several business quoting software options available that can help automate the process above. You will still need to know your figures, but once all your costs are setup in the system, it should really shave some time off your quoting admin hours. It also helps you to avoid costly human errors (which, when you’re strapped for time is a real possibility).

The real bonus is the customer service element: you can generate quotes from anywhere using an app on your smartphone. You can also check the status of a quote online (customers can often accept your quote online by clicking a button) and easily convert quotes into invoices once the job is completed.

When it comes to quoting in your small business…

Do:

- understand your customers – what drives them to buy? Are they price shoppers or value shoppers? Competing for price-driven shoppers can often just be a race to the bottom – you should only chase those customers so long as you can remain profitable

- prepare a written quote on branded letterhead – this looks more professional and is preferable to a verbal quote (which, while legally binding, doesn’t provide a written record of your agreement with the customer)

- Include detailed terms and conditions – this is your opportunity to communicate your terms of payment eg you may require a deposit, periodical payments or half the cost upfront etc

- Set out variations – this is how different scenarios will affect the selling price. Variations can present an opportunity to up-sell; for example, you may be able to charge extra for clearing rubbish from a work site or dealing with any unused materials

- Track labour and materials needed on each job – this will help you to quote similar jobs more accurately in the future

Don’t:

- miss the opportunity – get your quotes out to potential customers in a timely fashion

- forget to follow up – far from hassling prospects, a simple phone call can allow you the opportunity to resolve any concerns that are preventing them from saying ‘yes’. If they let you know that they have chosen a competitor, ask for feedback that may help you improve your offering

- compare your prices with non-competitors – only compare with direct competition. Don’t lower your prices to meet those of a company who positions themselves as a budget option if that’s not how you have chosen to position your brand in the market

You win some, you lose some

Don’t be too concerned if you do everything right and still miss out on a job or sale. If you are winning every quote you put out, then chances are your prices are too low. Once you’ve found your pricing sweet spot, you’ll still be knocked back at least some of the time. By following the tips outlined above, you should be able to price for profitability, while still improving your ‘yes’ rate. Win-win!

Table of Contents

First up: are you aiming at the right target (market)?

Did you answer ‘yes’ to all three questions?- A quick note on Mark-up vs Margins

- Why does this matter?

- A formula for quoting success

- Working out the details: the anatomy of a selling price

- Technology can help you quote faster (and more accurately)

- When it comes to quoting in your small business…

Do: - Don’t:

- You win some, you lose some