Victoria’s Interest Rates and Credit Conditions 2026: What Tighter Lending Means for Construction and SMEs

This article is part of Tenfold’s Victoria’s Economy 2026 series for owners in construction, trades and manufacturing. In earlier instalments, we explored input costs and labour market pressures. This article turns to one of the most influential forces shaping business decisions in 2026: interest rates and credit conditions. For Victorian SMEs, especially those in construction and manufacturing, access to finance is a critical lever for growth, cash flow stability and project delivery.

As a business coach working with Victorian operators every day, I see how interest rates and lending standards directly affect quoting behaviour, investment decisions, and the ability to scale. This article breaks down the current environment (as of late 2025), what to expect in 2026, and the practical steps owners should take to remain financially resilient.

Victoria’s Credit Environment in 2026

Interest rates in Australia remain elevated heading into 2026, even as inflation moderates. The RBA has signalled a cautious approach to easing, and major banks continue to apply tighter lending criteria across business loans, equipment finance and property-backed facilities. For Victorian SMEs, this means borrowing remains more expensive, approvals take longer, and lenders are scrutinising cash flow, profitability, and balance sheet strength more closely than at any point in the past decade.

Construction and manufacturing businesses are particularly exposed. Higher rates increase the cost of holding inventory, financing equipment and funding work in progress. Tighter credit conditions also affect clients (especially developers and homeowners), reducing project starts and slowing decision-making. For owners, the key is to understand how these financial settings translate into demand, cash flow, and risk, and to adjust pricing, forecasting, and capital planning accordingly.

Interest Rates: High for Longer

Interest rates have stabilised but remain well above the levels businesses grew accustomed to between 2015 and 2020. Inflation has eased, but not enough to trigger rapid rate cuts. The RBA’s messaging throughout 2025 has been consistent: any reductions will be gradual, measured and dependent on sustained inflation control.

For Victorian SMEs, this means borrowing costs will remain elevated through 2026. Equipment finance, overdrafts, business loans and property-backed facilities all remain significantly more expensive than they were five years ago. This affects everything from vehicle upgrades to factory expansions to the ability to carry large work-in-progress balances.

Key Interest Rate Drivers in 2026

Inflation moderation has been slower than initially expected, posing challenges for economic planning and policy formulation.

Following a rapid tightening cycle, the Reserve Bank of Australia (RBA) is exercising caution to ensure that monetary policy remains effective without over-tightening the economy. This cautious approach aims to strike a balance between controlling inflation and supporting economic growth.

Global interest rate settings continue to influence local policy decisions, adding another layer of complexity to the economic environment. These external factors require careful consideration by policymakers as they navigate domestic economic conditions and strive to maintain financial stability.

Credit Conditions: Tighter and More Selective

Even more than interest rates, credit conditions are shaping business behaviour in 2026. Banks are applying stricter serviceability tests, requiring stronger financials, and taking longer to approve loans. For construction and manufacturing businesses, lenders are particularly cautious due to sector volatility, project risk and the number of insolvencies seen in recent years.

This means businesses with inconsistent cash flow, thin margins or outdated financial reporting face real barriers to accessing finance. Even strong operators are experiencing longer approval times and more documentation requirements. For many SMEs, this is the tightest lending environment they’ve experienced in over a decade.

How Tighter Credit Impacts Construction and SMEs

Higher Working Capital Requirements for Projects and Inventory

The current financial environment has led to increased demands for working capital, especially for projects and inventory management. Businesses now need more cash on hand to cover project execution and maintain adequate inventory levels, which can tie up significant cash and strain liquidity.

Slower Approvals for Equipment Finance and Vehicle Upgrades

Obtaining approval for financing equipment and vehicle upgrades has become more protracted. Loan approval processes are taking longer due to stricter lending criteria and increased scrutiny, which can delay essential upgrades and depreciate operational efficiency.

Increased Scrutiny of Cashflow, Profitability, and Director Guarantees

Financial institutions are now scrutinising cash flow statements, profitability metrics, and director guarantees more meticulously. This heightened oversight aims to reduce risk exposure but can also complicate approval processes, making it more challenging for businesses to secure necessary funding.

Reduced Borrowing Capacity for Property-Backed Lending

Lenders are tightening their lending criteria for property-backed loans, reducing borrowing capacity for many businesses. This limitation affects companies that rely on property assets for credit facilities, constraining their ability to access additional funds when needed.

Clients Delaying or Cancelling Projects Due to Finance Constraints

As a consequence of tighter financing conditions, clients are increasingly delaying or cancelling projects. Limited access to funding sources creates uncertainty and hesitation, impacting future revenue streams and project pipelines.

These pressures flow directly into quoting, scheduling and growth planning.

Flow-On Effects for Demand in Construction and Manufacturing

Tighter credit doesn’t just affect business owners; it affects customers. Developers face higher pre-sale hurdles, homeowners face stricter mortgage assessments, and commercial clients are more cautious with capital expenditure. This leads to slower project starts, longer decision-making cycles and increased price sensitivity.

For manufacturers, tighter credit affects both ends of the supply chain. Customers may reduce order volumes or extend payment terms, while suppliers may require stricter credit limits or upfront deposits. This creates a squeeze on working capital that must be managed proactively.

Cash Flow: The Pressure Point for 2026

With borrowing more expensive and credit harder to access, cash flow becomes the defining factor for business resilience. Many Victorian SMEs are carrying higher costs for materials, labour and overheads while also facing slower client payments. This combination increases the risk of cashflow gaps, especially for businesses with large project pipelines or seasonal fluctuations.

Owners who rely on overdrafts or short-term financing to bridge these gaps will immediately feel the impact of higher interest costs. Those who operate without strong forecasting or disciplined debtor management will find 2026 particularly challenging.

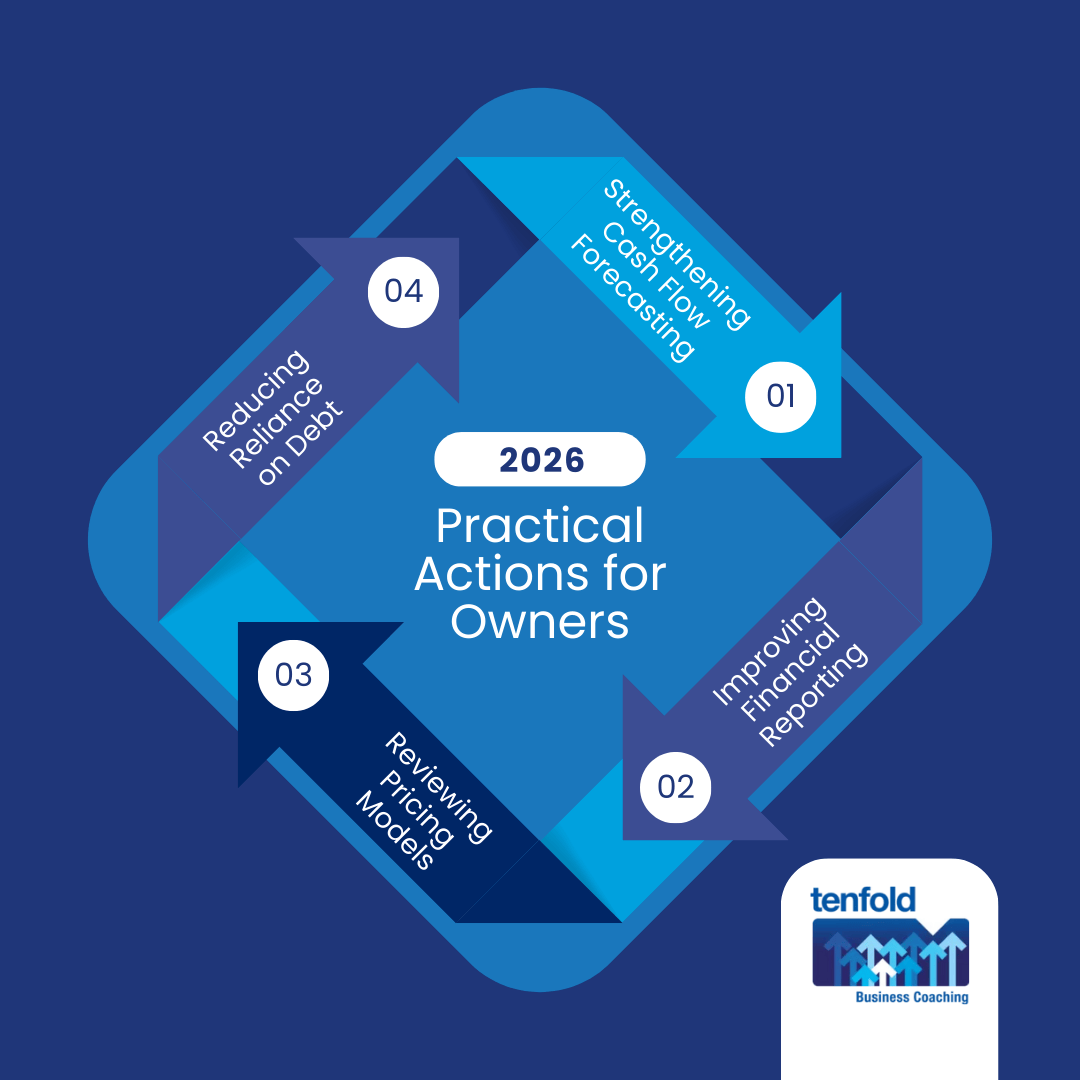

Practical Actions for Owners in 2026

To stay financially strong in a tight credit environment, owners should focus on:

Strengthening Cash Flow Forecasting

Strengthening cash flow forecasting is essential to maintaining a business’s financial health. By improving forecasting accuracy, companies can better anticipate cash flow gaps. This proactive approach allows them to take timely measures to address issues before they impact operations, ensuring stability and continuity. Implementing robust forecasting practices also enables more informed decision-making and strategic planning, ultimately supporting sustained growth.

Improving Financial Reporting

Enhancing financial reporting processes ensures that lenders receive a comprehensive view of the company’s performance. By providing clear and consistent information, organisations can effectively communicate their financial health and operational stability. This not only facilitates better lender decision-making but also builds trust and confidence in the company’s transparency and accountability.

Reviewing Pricing Models

This is essential to ensure that the margins are sufficient. This process helps to account for increased finance and working capital costs. By carefully analysing and adjusting these models, the company can maintain profitability despite higher expenses.

Reducing Reliance on Debt

Reducing reliance on debt is crucial for maintaining financial stability. By focusing on productivity improvements, organisations can increase output without incurring additional costs. Additionally, tightening job selection ensures only the most suitable candidates are hired, enhancing overall efficiency and performance. Together, these approaches help build a more sustainable and resilient financial foundation, reducing reliance on borrowed funds.

These steps significantly improve borrowing capacity and financial resilience.

Tenfold Insights: What We’re Seeing Across Victoria

Across the businesses we coach, the strongest performers are those treating finance as a strategic function, not an administrative one. They maintain up-to-date financials, review pricing regularly, and make investment decisions based on clear return-on-capital analysis. They also communicate proactively with lenders, which builds trust and speeds up approvals.

In contrast, businesses that delay financial reporting, rely on outdated pricing, or operate with thin margins are finding it increasingly difficult to secure finance. In a high-rate, tight-credit environment, discipline is a competitive advantage.

Build a Financial Strategy That Supports Growth

Interest rates and credit conditions in 2026 will continue to shape the operating environment for Victorian SMEs. Borrowing will remain more expensive, approvals will take longer, and lenders will expect stronger financial performance. The businesses that thrive will be those that plan proactively, price accurately and manage cash flow with discipline.

As a business coach working with Victorian trades, builders, and manufacturers for over 20 years, I’ve seen how strong financial systems transform resilience and profitability. If you want support building a more robust financial strategy, learn more about how Tenfold’s business coaches work one-on-one with owners through our business coaching services.