Victoria’s Economy 2026: Growth and Demand Snapshot for Trades, Builders and Manufacturers

Executive summary: What Victorian Business Owners Should Know about the State’s Economy

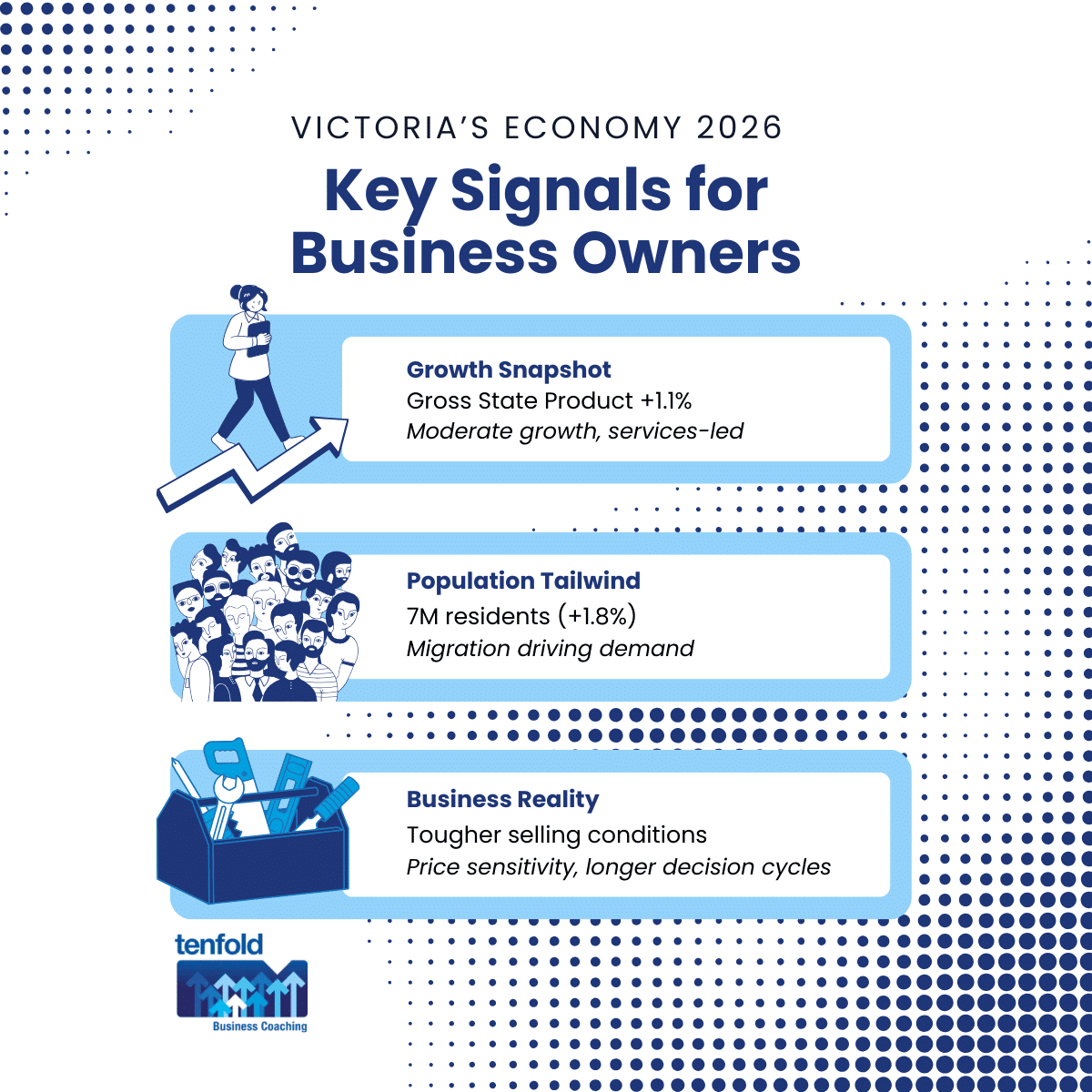

If you run a trade, building, maintenance, or fabrication business in Victoria, the last 6-12 months probably felt contradictory: busy in parts, slow in others, and harder to convert even when enquiries exist. The data supports that lived experience. Victoria is growing, but not fast, and demand is uneven. In 2024-25, Victoria’s gross state product (GSP) grew 1.1% (moderate growth), with service industries carrying much of the momentum. Household conditions remain pressured, which shows up as price sensitivity and longer decision cycles, while population growth provides a steady tailwind for underlying demand. Victoria’s population was around 7 million as at 30 June 2025 (up 1.8% from 2024), and net overseas migration remains a major driver. Rates remain elevated, and inflation remains a key narrative shaping customer behaviour. The RBA held the cash rate at 3.60% and signalled ongoing focus on inflation. This guide (Part 1) sets the macro context for Tenfold’s Victorian Economy series and provides owners with a practical lens for pricing, capacity, cash flow, and pipeline decisions.

What it feels like on the ground vs what the data says

This is Part 1 of Tenfold’s Victorian Economy series. The reason I’ve written this series is simple: as a business coach, I can translate macro signals (the headlines) into practical decisions for Victorian trades, builders, maintenance contractors, and manufacturers. Each post will tackle one factor (pipeline, costs, labour, rates, insolvencies, procurement, confidence, supply chains, inflation, and cost of living) so you can make clearer calls on pricing, capacity, cash, and where to focus your sales effort.

On the ground, many operators describe the same pattern: “We’re not dead, but it’s not easy.” You might still have work, but clients negotiate harder, shopping around is more common, and the time between quote and decision has stretched. That doesn’t contradict the economy “growing”; it’s exactly what moderate growth and uneven demand looks like when households are under pressure and cost bases are higher than they were two years ago.

If you could use a sounding board or use a business coach in Melbourne to sense-check your next moves, this series is designed to give you the external context so your internal decisions are tighter. You’ll find practical insights you can apply, not generic commentary.

The bigger picture snapshot: moderate growth, with services doing the heavy lifting

Start with the headline: Victoria’s economy is growing, but it’s not a boom. ABS State Accounts show Victoria’s GSP (the Gross State Product, a state’s version of GDP) grew 1.1% in 2024-25. That’s meaningful (it’s not recession conditions), but it is modest by historical “everyone’s flat-out” standards.

The second point is the mix. Growth has been supported by services. Strength across service industries matters because it shapes where income and employment growth shows up first. For many construction and fabrication businesses, services-led growth can still be positive (more activity, more movement of goods, more maintenance), but it often doesn’t translate into the same surge in new builds you’d see in a construction-led upswing.

The practical read: plan for steady conditions with pockets of opportunity, rather than pricing and staffing as if a broad-based boom is about to arrive. When growth is moderate, execution matters more: quoting systems, conversion discipline, scope control, and cash management tend to separate the winners.

Demand reality: growth exists, but selling conditions are tougher

A useful way to reconcile “the economy is growing” with “selling is harder” is to separate overall demand from household spending power.

Victorian Treasury’s 2024–25 Mid-Year Financial Report points to growth in state final demand while also noting that real consumer spending has been subdued amid elevated interest rates and ongoing consumer price pressures. For owner-operators, that shows up in very specific ways: residential clients delay non-urgent upgrades, redesign to lower specs, or stage projects; small commercial clients seek more quotes and push harder on rates; builders and project managers get stricter on variations and documentation because they’re protecting their own margins.

The implication isn’t “no demand.” It’s “more friction.” In friction environments, you win by tightening the sales process (faster responses, clearer inclusions/exclusions, stronger qualification) and by treating scope creep as a margin leak, not an admin annoyance.

Population tailwind: more people, more baseline demand (and more constraints)

Population growth matters because it underpins medium-term demand for housing, infrastructure, maintenance, logistics, and local manufacturing throughput.

ABS data shows Victoria’s population was around 7 million at 30 June 2025, up by 123,500 people over the year. Net overseas migration is a major contributor. For trades and builders, population is a demand tailwind, but it doesn’t automatically mean easy work right now.

Where population growth supports demand

Population growth increases the need for housing (new supply and upgrades to existing stock), utilities connections and energy upgrades (including solar and electrification work), commercial services (fit-outs, compliance, reactive maintenance), and manufacturing output and fabrication (components, maintenance parts, and project inputs).

Where population growth tightens constraints

Population growth can also tighten constraints: competition for labour, pressure on approvals and planning capacity, and stress on supply chains and subcontractor availability. The owner takeaway is not “gear up for a boom,” but “assume baseline demand will remain, and build a business that can capture it profitably without overextending.”

Rates and inflation: why customers behave differently even when they can afford it

Higher rates change behaviour before they change employment. Even for clients who still have income, elevated repayments and higher living costs make them more cautious. That caution shows up as longer decision cycles, smaller scopes, and more scrutiny of value.

In its November 2025 Statement on Monetary Policy overview,, the RBA held the cash rate target unchanged at 3.60% and highlighted inflation as the key narrative shaping policy. Whether a client reads that statement or not, the effect flows through to lending rates, budgets, and “do we really need to do this now?” conversations.

For construction and manufacturing businesses, this environment punishes sloppy estimating and rewards clarity. If your quote doesn’t control risk, you either lose the job or win it and regret it. If your value proposition is vague, the cheapest bid wins more often. If your cash cycle is loose, delays and disputes become existential faster.

Labour market: still tight, but easing at the edges

Many operators still say “finding good people is hard.” The data suggests the labour market remains relatively tight, though conditions have been easing compared to the most constrained period.

ABS Labour Force reporting through late 2025 shows unemployment in the low-to-mid 4% range, with participation still high. In practical terms, that’s not a slack labour market where great workers are lining up. It’s a market where you often need to recruit continuously, pay attention to retention, and lift productivity per crew hour rather than assuming you can simply “hire your way” into growth.

What easing can look like on the ground: more applicants than six months ago (but not necessarily more high-quality applicants), slightly less wage shock (but ongoing pressure for experienced trades), and more movement between employers as people chase stability and better scheduling.

Owner takeaway: treat labour as a capacity strategy, not an HR task. Decide what work you will and won’t take based on your true productive capacity, and build a hiring and training plan that matches your pipeline quality, not your optimism.

What it means for builders, trades and manufacturers in Victoria

Residential construction trades (electrical, plumbing, HVAC, concrete, landscaping, solar)

Expect more quote competition and more “value engineering” by clients and builders. Win by tightening scope, documenting assumptions, and building a repeatable quoting process that protects margin when materials or access conditions change. When demand is uneven, speed-to-quote and follow-up discipline can matter as much as price.

Residential custom home builders

Moderate growth and pressured households usually means fewer “emotional yes” decisions and more finance-conditional decisions. Allow for longer pre-construction phases, more design iterations, and more client questions. Your edge is process certainty: selections, variations, and contract administration that reduces surprises and keeps cash predictable.

Commercial trades (maintenance / facilities)

This segment often holds up better in uneven demand because assets still need to run. But procurement becomes stricter, and pricing scrutiny increases. The winners are those who can prove response times, compliance, and total cost-of-ownership outcomes, not just hourly rates.

Manufacturing / fabrication

Services-led growth and population growth can support throughput, but margins can be squeezed if input costs and labour productivity aren’t controlled. Focus on job costing accuracy, scheduling discipline, and reducing rework. In a moderate-growth economy, operational excellence is a competitive advantage, not a “nice to have.”

So what should a Victorian business owner in trades, building or manufacturing owner do with this?

Plan for moderate growth, not a boom; assume tougher selling conditions even when underlying demand exists and win with fundamentals.

Four decision areas to tighten now

- Pricing and margin protection: Know your true costs, build clear inclusions/exclusions, and price risk intentionally (don’t “hope it works out”).

- Quote quality and conversion: Improve speed-to-quote, qualification, follow-up cadence, and job selection. In friction markets, fewer but better-fit jobs can outperform a big “maybe” pipeline.

- Scope control and delivery: Reduce variation leakage with better documentation, site readiness checks, and change control processes.

- Cash discipline and capacity planning: Update cashflow weekly, manage receivables tightly, and match hiring/subcontracting decisions to confirmed work, not enquiries.

This is exactly why I’ve written this series on the Victorian economy: to help business owners build a decision framework that fits the reality of Victoria right now.

If you want hands-on support turning this into practical actions in your business, Tenfold Business Coaching works 1:1 with owners to tighten pricing, pipeline decisions, and cashflow rhythms without overcomplicating the operation. That’s what effective business coaching should do.

Series roadmap and navigation

In the next posts, I’ll look at: the construction pipeline (public and private), approvals and commencements, input costs, labour and wages, interest rates and credit, insolvencies and payment times, government procurement, business confidence and investment, supply chains and imports, and inflation/cost-of-living.

Every business coach at Tenfold is using these insights in the strategies for our clients. Speak to us about how to take advantage of this intel in your business.

FAQs

If Victoria is growing, why does it feel harder to win work?

Moderate growth can still come with tougher selling conditions when households are cautious and clients shop around more. The work is there, but friction increases: longer decision cycles, more quotes requested, and more scrutiny on scope and price. That’s why tightening quoting, qualification and follow-up matters more than it did in boom conditions.

Does population growth automatically mean more work for trades and builders?

It supports baseline demand over time, but it doesn’t guarantee easy work in the short term. Population growth also increases constraints like labour competition and pressure on planning, approvals and subcontractor availability. Treat it as a medium-term tailwind and build systems that capture the work profitably.

What’s the biggest operational risk in this kind of market?

Underquoting risk and scope leakage. When clients are price-sensitive and costs remain elevated, small mistakes in estimating, inclusions and variations quickly wipe out profit and strain cashflow. Strong documentation and change control protect margin.

How should I adjust hiring decisions if the labour market is “tight but easing?”

Hire to confirmed work and measured capacity, not hope. Improve retention and productivity first, then recruit with clear role outcomes and onboarding so new hires lift output rather than create supervision drag. Capacity planning should follow your best-quality pipeline, not your busiest week.

What should I do first if I want to stabilise margins and cash in the next 90 days?

Start with job costing accuracy and a tighter quoting process (scope, exclusions, assumptions), then implement weekly cashflow visibility and firm receivables routines. Once the basics are consistent, you can choose which pipeline opportunities to pursue with more confidence and less risk.