Australian Federal Budget 2020-21: What it means for small-medium businesses

I’m here with a review of the Australian federal budget 20/21 for Australian businesses on Wednesday 7th October.

Like many of you, I tuned in to watch the budget announcement last night. I’ve also assessed it through the lens of what this means for Australian small businesses and the markets you service.

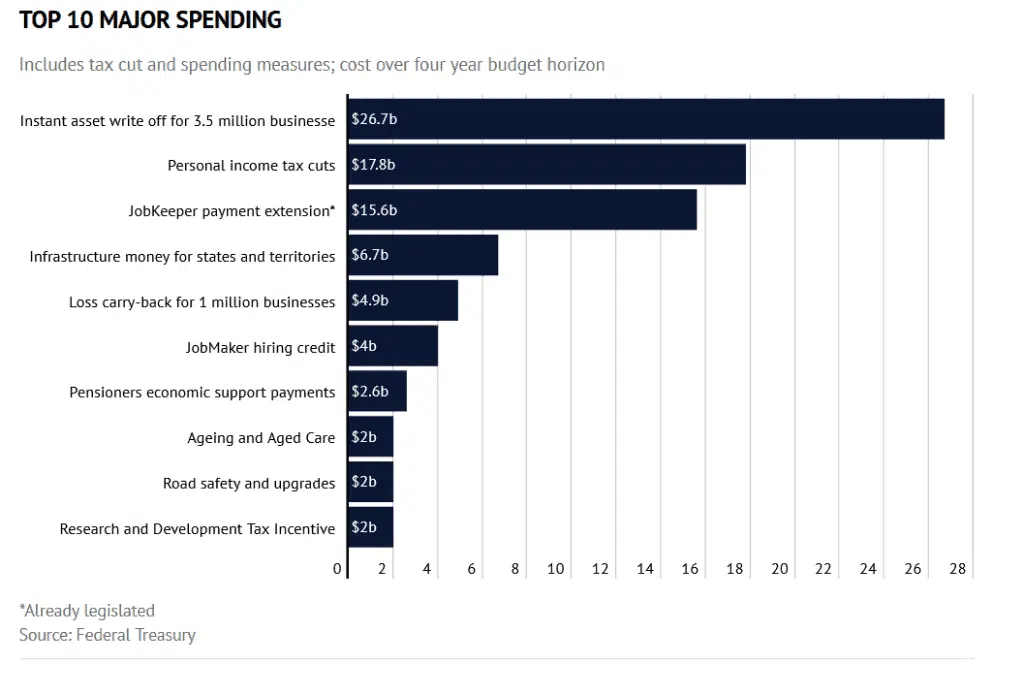

My overarching view is that this budget is geared to support Australian businesses to keep spending and keep hiring. This huge amount of investment will help generate confidence across the whole economy. As Australian consumers and businesses feel wealthier, that will stimulate spending on many levels, and encourage businesses and individuals to act in a non-recessionary manner.

Budget announcements that are relevant for your Australian business

JobMaker hiring credit

Overview:

Credits will be paid to businesses that hire people under 35 years old. The key test is that the new employee received the Jobseeker payment (or other government subsidy) for at least one month out of the three months before being hired.

The employer will also have to prove the overall number of employees has increased, and that the new employee works for at least 20 hours a week, averaged over a quarter.

The hiring credit will be paid at the rate of $200 a week for hiring people aged 16 to 29, or at $100 a week for 30- to 35-year-olds. Employers can receive this hiring credit for 12 months. The scheme begins 7th October.

Tenfold’s perspective:

• Beneficial for many small businesses who might consider employing one or more roles that could be filled by a young person. For a 29-year old that has been on JobSeeker or a relevant government subsidy this would equate to an approximate $10,000 subsidy over the year.

• Opportunity to employ 2 young people on 20 hours per week and effectively double dip on the subsidy.

• Could have the impact of stabilising or even pushing up wages for job experienced people who aren’t looking for their first job, but are under 30.

• Remember the person must have been on JobSeeker or an equivalent subsidy for one of the three months prior to their employment. We will start to see candidates advertising the fact that by employing them, you as an employer will become JobMaker credit eligible.

Before you take advantage of this opportunity, consider what your business needs. Our business coaching services will be able to help you plan your workforce and recruit the right resources for your planned growth.

Apprentice / Trainee subsidy

Overview:

I wrote about this subsidy on Monday – see here: https://tenfoldcoaching.com.au/covid-19-business-continuity-5th-october/.

As a reminder, businesses that hire a new or recommencing apprentice or trainee will qualify for a 50% wage subsidy. The subsidy will be to the value of $7,000 a quarter, from 5 October 2020 until 30 September 2021.

Tenfold’s perspective:

• For trade-based businesses, this is an opportunity to win more work in lower skill jobs and utilise apprentices to complete the works. The subsidy is worth up to $28,000 per apprentice over the year.

• For all businesses, this is an opportunity to employ a trainee in a business admin role and fill a low skill function in your office; think: general admin, reception, data entry.

Be aware that while trainees can be a low cost resource for your business, they aren’t a free-kick. They will need supervision and development to ensure they are performing the role to the standard your business needs. A Tenfold business mentor can give you advice on job-based development plans and performance management for trainees.

Instant asset write off

Overview:

Businesses with a turnover of less than $5 billion will be able to deduct the full cost of capital assets purchased from today and first used or installed by 30 June 2022.

Note: this time, there is no limit to the amount you can claim for instant write off (in recent times it has been capped at $150K).

Small and medium businesses will also be able to apply “full expensing” to second-hand assets.

Tenfold’s perspective:

• Benefits for you: you’ll be able to purchase vehicles, machinery, office fit out and reduce your tax liability in the first year (for how this works, see my briefing on 10th June)

• Secondary benefit: big businesses (up to $5B in turnover) will get the write off and so we can expect significant investment by large manufacturers and other capital investment intensive businesses. This will flow down to many of our clients who provide services to the industrial and manufacturing sectors.

If you’re considering any capital purchases, run it through your financial model first so that you can be confident that you have accounted for the associated operating costs. Tenfold business coaches can help you plan out utilisation costs of equipment and machinery to use in your financial modelling.

Carry back losses

Overview:

Companies with turnover up to $5 billion will be able to offset losses against previous profits on which tax has been paid, thereby entitling them to a refund on taxes previously paid.

Tenfold’s perspective:

• A strong cash flow boost for some businesses who have been most impacted by the restrictions. This will see them receive a refund on company tax paid in the past couple of financial years and so be able to use those funds to deal with weathering the extended restrictions. I see this as a small but significant benefit for severely impacted businesses.

Infrastructure spending

Overview:

The federal government will invest $14B in new and accelerated infrastructure projects over the next four years in every state and territory, including Melbourne to Brisbane inland rail.

Another $3B will go towards shovel-ready projects to support further job creation and economic recovery, including small scale road safety projects.

Tenfold’s perspective:

• Funds will be provided directly to councils to upgrade local roads, footpaths and street lighting, Some Tenfold coaching clients already service this sector, with other clients actively pursuing strategies to enter this market.

• More funds for affordable housing on top of what has already been announced

———————————

Budget announcements that are relevant for you and your employees

Personal tax cuts

Overview:

Most Australians will receive tax cuts. The tax changes work out to be about $20 per week extra for a worker earning between $48,000 and $90,000, with people earning more than that getting a larger benefit, up to a maximum of $2,430 per year.

From 2020-21, the upper limit of the 19% personal income tax bracket will rise to $45,000 and the 32.5% marginal tax rate upper threshold will lift from $90,000 to $120,000.

Tenfold’s perspective:

• Paying less tax will mean people have more in their take home pay, which will give people a sense of confidence in their financial situation. General consumer spending, especially in the discretionary sector, should be good for all businesses as people have the confidence and the funds to spend money on goods and services. If people feel wealthier they are more likely to embark upon a house renovation, build a pool, landscape their garden, upgrade their car, spend more on a holiday, spend more on day to day discretionary purchases (clothing, restaurants etc).

• The tax cuts effectively provide a pay rise to your employees. While their gross income might not be affected, their net income will improve substantially.

To understand more about the tax cuts and use a tool to calculate how much you’ll actually save, visit: https://www.abc.net.au/news/2020-10-06/budget-2020-income-tax-calculator/12732348

———————————

As long as the state borders open up and Australia doesn’t suffer a third wave of the virus, this volume of spending should inspire increased confidence and growth in spending on products and services. Be prepared for the uplift.

Ash

Ashley Thomson B.Eng(Hons), Grad. Dip. Mgmt, MEI

Managing Director

Tenfold Business Coaching