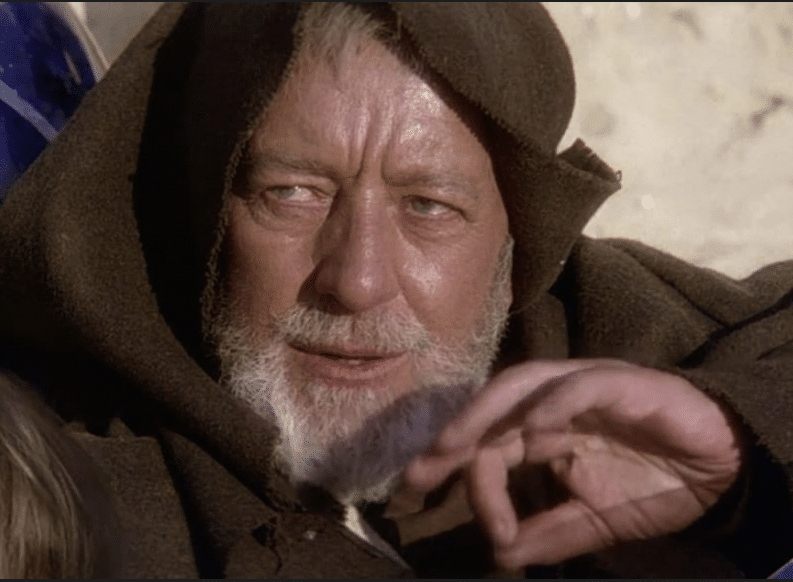

This is not the page you are looking for

You could try searching or just head back to the home page.

Recent Articles

Short, informative reads

A Guide to Systemising your Business

Welcome, small business owner. As a business coach, I’ve worked with business at different stages of growth so I know what ...

Sales Prospecting: A Guide for B2B Service Providers [Examples]

Sales prospecting is like Vegemite; some people love it, some people can’t stand it. Those who love it don’t get what the ...

Bounce Back from a Sales Slump: Actions To Boost Your Sales

Understanding Sales Prospecting What is Sales Prospecting? In the world of small to medium-sized B2B service businesses, hitting a sales slump ...