Business Insights – Why business owners should be focusing on investing NOW

Today I want to bring you some insights on investing in your business, as well as other passive investments and the Australian property market in particular.

Before I start, let me point out that Tenfold business coaches certainly aren’t financial planners and so we can’t give financial advice. However, we are committed to ensuring you grow your wealth – many of you have experienced this with our Net Wealth tracking tool that we use in our one-on-one coaching.

I know from speaking with you directly and hearing from your business coach that you work hard in your business but many of you don’t always work as hard when it comes to the investments you hold for your future, whether it is your super, shares, an investment property, or your office/factory/showroom. You’ll stay up to date with developments in your industry and you’ll put in the extra hours to grow your business, but your knowledge and analysis of your investment portfolio is sometimes overlooked.

I wrote in January this year that now is one of the best times I have ever seen to be investing (in your business and other investments). That was off the back of the 2020 reopening, the massive amounts of stimulus money sitting in people’s bank accounts and the ultra-low interest rates. You may recall that I explained the factors creating this opportunity in the client briefing on 22 January 2021. At that time industry analysts were predicting the property market to grow between 5 to 15% this year. Now nine months later we know that the property market is up 15.0% in Melbourne, 23.6% in Sydney and 19.9% in Brisbane.

My purpose in this briefing is not to sway you to invest in the property market or any particular asset class, but to again point out the undeniable factors that currently exist that make investment attractive now. Secondly, I want those of you who are further advanced in your coaching and are leading more established and stable businesses to use this as a prompt to allocate more of your time to learning about investing and your investments.

Let me provide 3 insights that explain why now is the time to be seriously looking at your investments:

1. Cashed up economy

Significant amounts of stimulus have been pumped into Australian businesses. To give you context for the scale, economists report that since the pandemic first struck, Australian households have amassed an extra $120 billion in deposits – that’s an average of $6000 per adult. Further, a CBA economist calculates that by the end of 2021, Australian households will be sitting on “a whopping $230 billion in accumulated savings when you account for the extra cash used to pay down mortgages, credit cards and other loans ahead of schedule”.

This is money sitting in people’s and businesses’ bank accounts waiting to be spent and invested. See: https://www.theage.com.au/money/banking/230b-in-household-savings-tipped-to-drive-spending-splurge-20211004-p58x1x.html

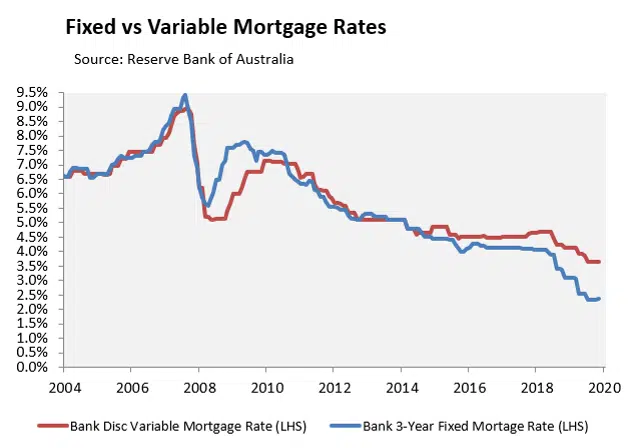

2. Interest rates are (still) low

Interest rates for investment property are extremely low. For a brief period recently, you could fix your loan for 3-4 years on an interest rate under 2% per annum. The rates are now slightly above 2%, but still lower than they have been for decades. In 2020, low rates along with the HomeBuilder stimulus drove owner occupiers to build new homes.

Investors are starting to realise the advantage of these current conditions: the combination of low interest rates and positive rental returns is offsetting the cost of owning an investment property, office or factory. This is becoming more pronounced in Melbourne and Sydney as those cities reopen.

3. Government action to moderate the housing market

The government, the Reserve Bank and APRA (the authority that regulates the banks) have identified that house prices have risen substantially and are likely to rise a lot further. To moderate the housing market, they’ve recently put in place some restrictions on how much the banks can lend you in the hope that it reduces the number of people driving up house prices. See: https://www.corelogic.com.au/news/making-sense-macro-prudential-changes.

Despite these stricter lending conditions, it has had almost no impact on the speed of growth of the property market and so it is likely the regulators will take further and more decisive action in coming months.

Bringing it all together

As a business coach, my suggestion is this: over the coming years is to continue to work on building your business, but also educate yourself on your investments. Business profits will drive your excess cashflow, while prudent investments will drive your long-term wealth.

As we have seen during the last two years, even a business built on a solid foundation with sound risk management protections can suddenly be undermined by factors outside your control. Having an investment plan gives you a back-up option if something unexpected does impact your business.

Review and update your Net Wealth Tracker with your Tenfold business coach to ensure that you have a clear view of your financial goals over the short and long-term, so that you know which areas to focus your investment attention and effort.

As business mentors, the team at Tenfold have contacts with different advisors in the wealth management space. If you want some outside advice, speak to us and we can steer you towards someone who we feel might be right for your circumstances and your goals.

Ash

Ashley Thomson B.Eng. (Hons), Grad. Dip. Mgmt, MEI

Managing Director

Tenfold Business Coaching