4 Essential Cash Tips for any SME

You have probably heard that 60% of SME businesses cease trading in the first 3 years. In a lot of cases, I think these are the lucky ones. The owners that I really feel for are the ones that are staying in business for years on end and only just managing to keep their head above water: sacrificing family time, holidays, dinner with friends, restful nights… they can only ever see as far as the next BAS bill.

You may also realise that the failed and struggling businesses are almost invariably hamstrung because of a shortage of cash. That doesn’t mean that they weren’t getting sales or even making a profit, but sales and profits don’t necessarily mean cash when you need it. And eventually no cash means, well, shut the doors.

If you’re lucky you can just walk away and there aren’t any liquidators claiming “insolvent trading” and coming after the family home (and don’t think simply trading through a trust will necessarily prevent this…)

It’s not rocket science but it is crucial, the below 4 Absolute Essentials for small business owners to avoid being another ABS SME statistic:

1. Invoice quickly and collect your debts regularly:

It may seem obvious but in fact 95% of the businesses that I come in contact with are either not invoicing as soon as they can or are not recovering debts when they are due.

If you are running a business and the cash is not already tight, trust me, the day will come when you need to either cover an unexpected event or invest in something new and expensive.

Ensuring that your sales process is tight and your debtors are well trained will one day be the difference between survival/investing and destruction/languishing.

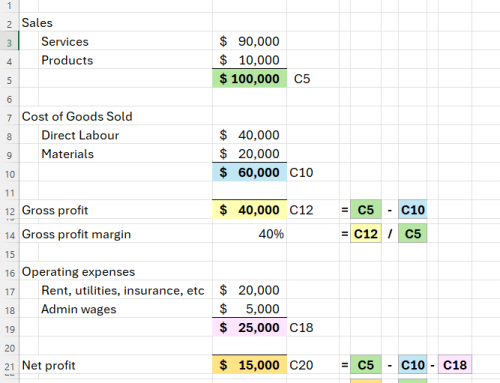

2. Know your numbers!

Question: If you stopped earning today, right this minute – what time on what day would you run out of cash?

Question: How many sales do you need to make each day this week to be sure you can collect in time to cover the expected Christmas downturn?

I know that there are so many priorities, I know there’s a bazillion things to do, really – I get it.

But you have to understand all of the cash implications before you:

a. make that next big investment,

b. tell your largest debtor they can have an extra 15 days to make payment,

c. calculate the amount of inventory you should purchase, or

d. well, make any other decision at all, really.

Pro Tip: Knowing your numbers means you can make good decisions quickly without feeling like you’re backed into a corner.

Related article: The 6 Numbers You Need to Know To Run Your Business Profitably

3. Negotiate overdrafts in the good times:

It’s ironic but the truth is that the banks and suppliers are always going to be happy to lend you the money that you don’t need. The day that you do need it, all of a sudden, you are in a higher-risk category.

Pro Tip: Don’t wait until you need actually need the money to negotiate with your bank or suppliers for a finance facility; having it there doesn’t mean you have to use it.

4. Re-negotiate with suppliers regularly:

Everyone is in business to make money. If you haven’t reviewed all of your suppliers in the past 12 months, then you can be sure that either suppliers will have increased some prices or that there is another provider that can do the same thing cheaper.

Pro Tip: you don’t always have to change supplier, it is usually enough to let them know that you expect a better price and can get it elsewhere. At the very least you will make them think twice before they try to creep up prices next time!

If you are in a good cash position, then maybe it is time to negotiate a better price in return for payment up front. Of course, before you can do this you will need to “know your numbers”!

Remember – it’s the decisions you make and the actions that you take (or don’t take) today that will decide whether you grow, stagnate or even survive 6 months from today. Make sure you’ve given yourself the best chance by proactively staying in front of the key metrics and following the above 4 cash absolute essentials.

If you feel like your cash is controlling you instead of you controlling your cash, give us a call at Tenfold Business Coaching.